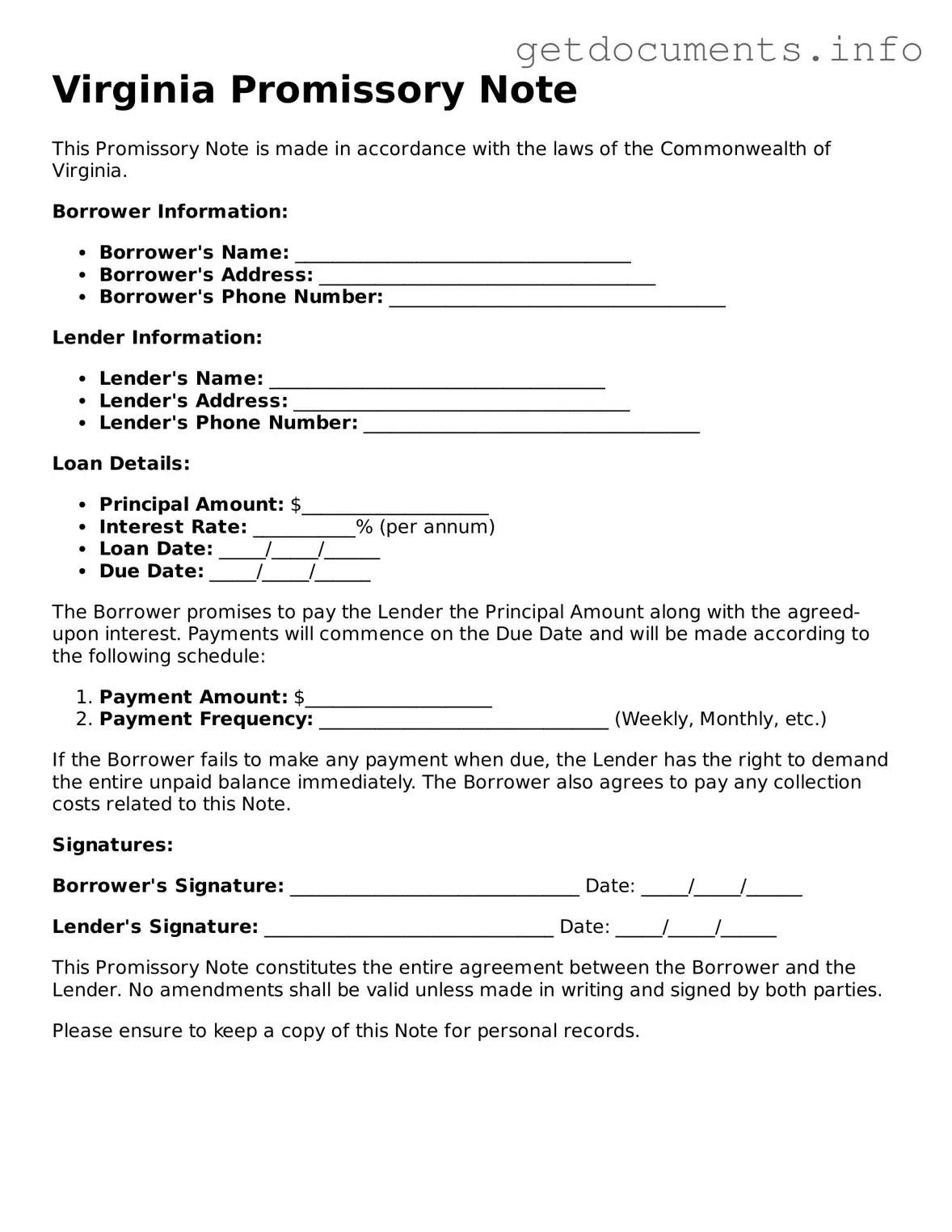

Free Promissory Note Template for Virginia

A Virginia Promissory Note is a legal document in which one party promises to pay a specific amount of money to another party at a designated time. This form outlines the terms of the loan, including interest rates and repayment schedules, ensuring clarity for both parties involved. To get started on your own Promissory Note, fill out the form by clicking the button below.

Access Promissory Note Editor

Free Promissory Note Template for Virginia

Access Promissory Note Editor

Got places to be? Complete the form fast

Fill out Promissory Note online and avoid printing or scanning.

Access Promissory Note Editor

or

⇩ PDF File