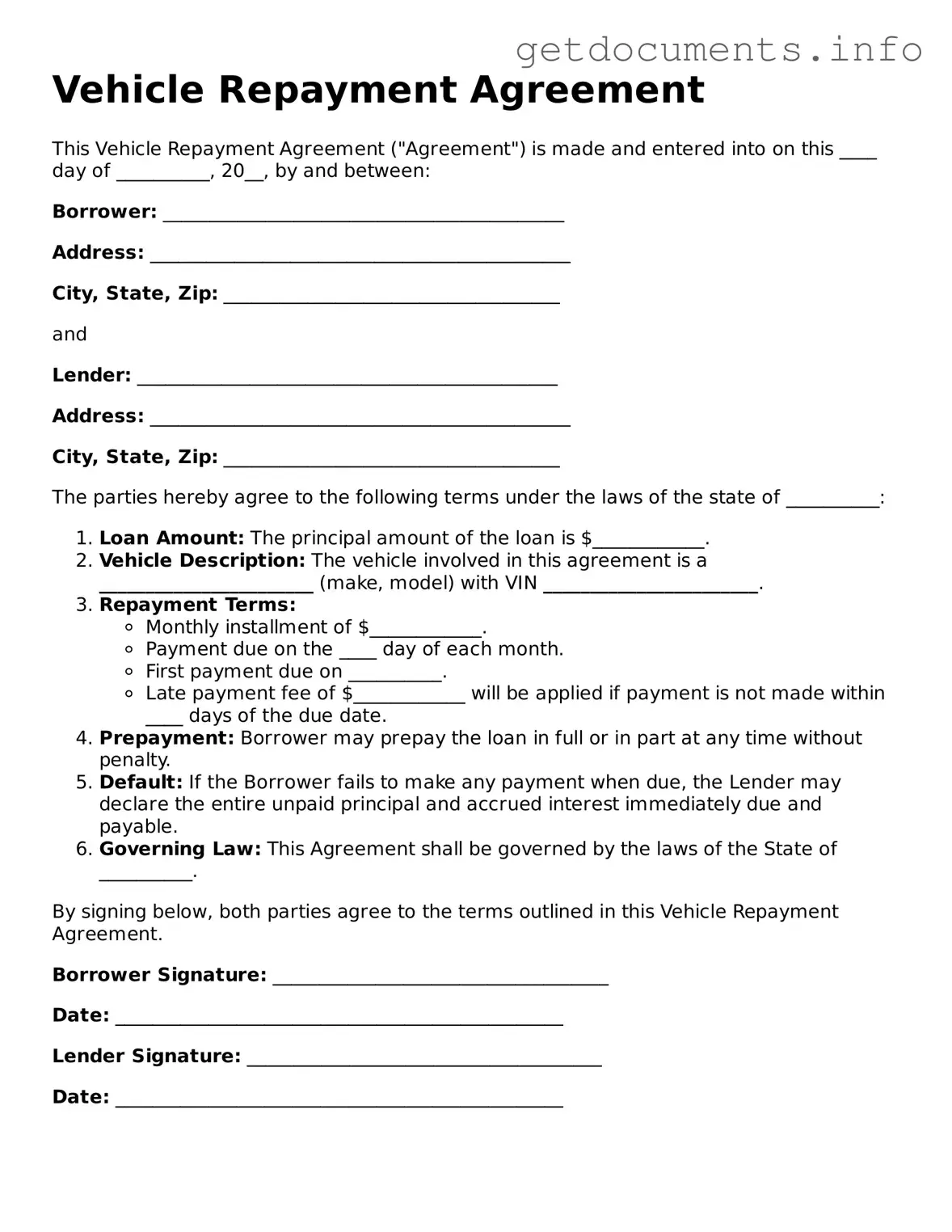

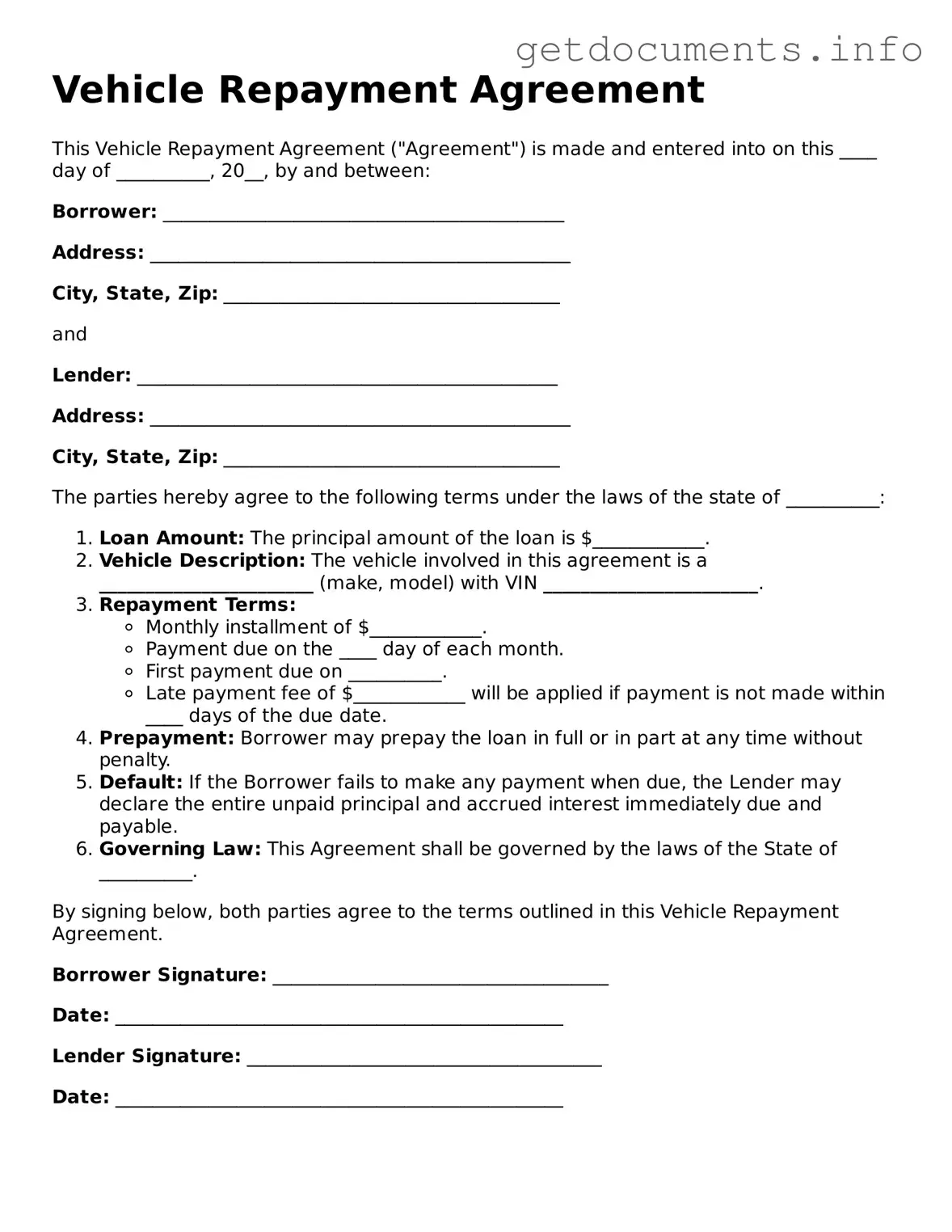

Printable Vehicle Repayment Agreement Document

The Vehicle Repayment Agreement form is a legal document that outlines the terms under which a borrower agrees to repay a loan for a vehicle. This form helps protect both the lender and the borrower by clearly stating the repayment schedule, interest rates, and any other relevant conditions. If you're ready to take the next step, fill out the form by clicking the button below.

Access Vehicle Repayment Agreement Editor

Printable Vehicle Repayment Agreement Document

Access Vehicle Repayment Agreement Editor

Got places to be? Complete the form fast

Fill out Vehicle Repayment Agreement online and avoid printing or scanning.

Access Vehicle Repayment Agreement Editor

or

⇩ PDF File