Free Lady Bird Deed Template for Texas

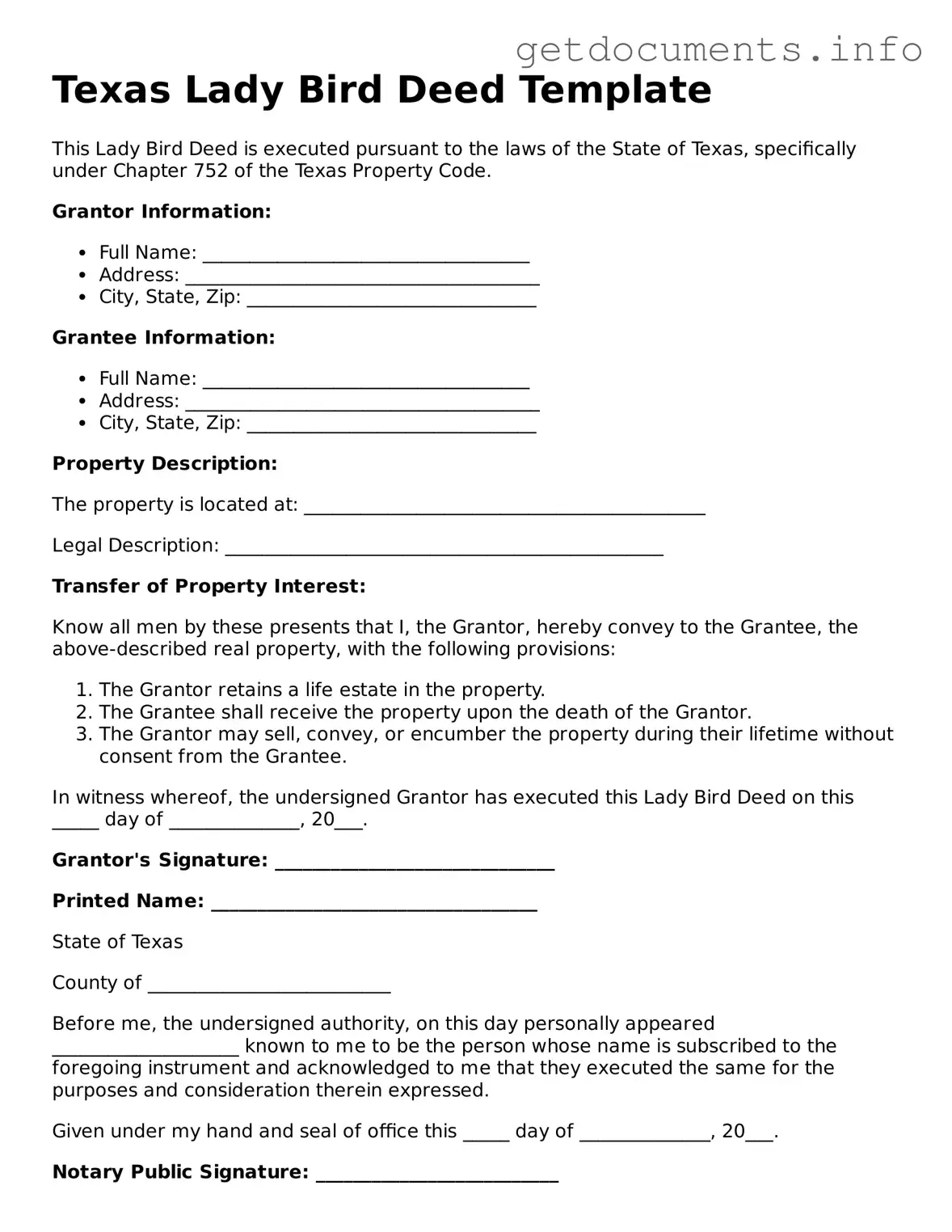

The Texas Lady Bird Deed is a legal instrument that allows property owners to transfer their real estate to designated beneficiaries while retaining the right to use and control the property during their lifetime. This type of deed facilitates the seamless transfer of property upon the owner's death, avoiding the complexities of probate. For those interested in this efficient estate planning tool, fill out the form by clicking the button below.

Access Lady Bird Deed Editor

Free Lady Bird Deed Template for Texas

Access Lady Bird Deed Editor

Got places to be? Complete the form fast

Fill out Lady Bird Deed online and avoid printing or scanning.

Access Lady Bird Deed Editor

or

⇩ PDF File