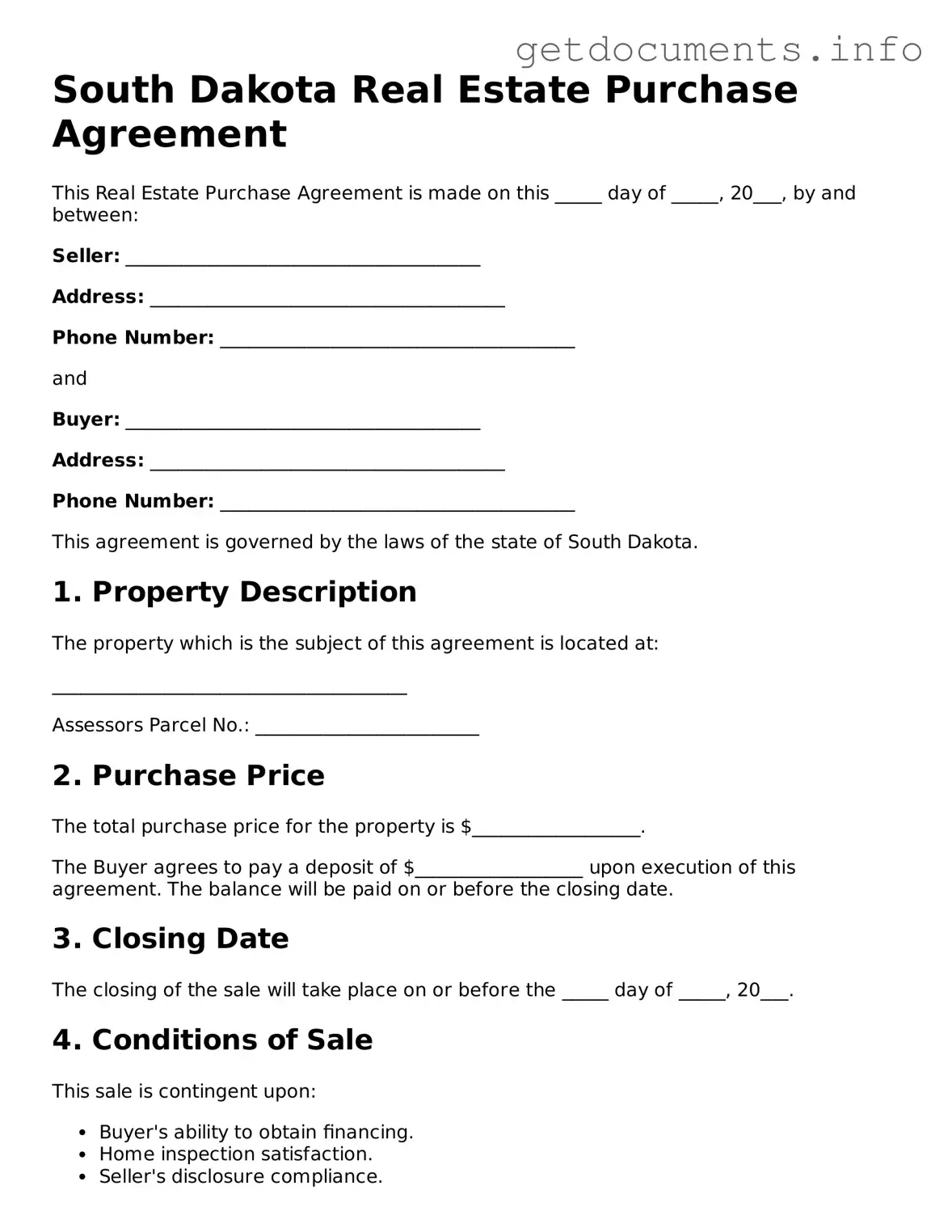

Free Real Estate Purchase Agreement Template for South Dakota

The South Dakota Real Estate Purchase Agreement is a legal document that outlines the terms and conditions for the sale of real property in South Dakota. This form serves as a binding contract between the buyer and the seller, detailing important aspects such as the purchase price, property description, and closing date. For those looking to initiate a real estate transaction, completing this form is an essential step; click the button below to get started.

Access Real Estate Purchase Agreement Editor

Free Real Estate Purchase Agreement Template for South Dakota

Access Real Estate Purchase Agreement Editor

Got places to be? Complete the form fast

Fill out Real Estate Purchase Agreement online and avoid printing or scanning.

Access Real Estate Purchase Agreement Editor

or

⇩ PDF File