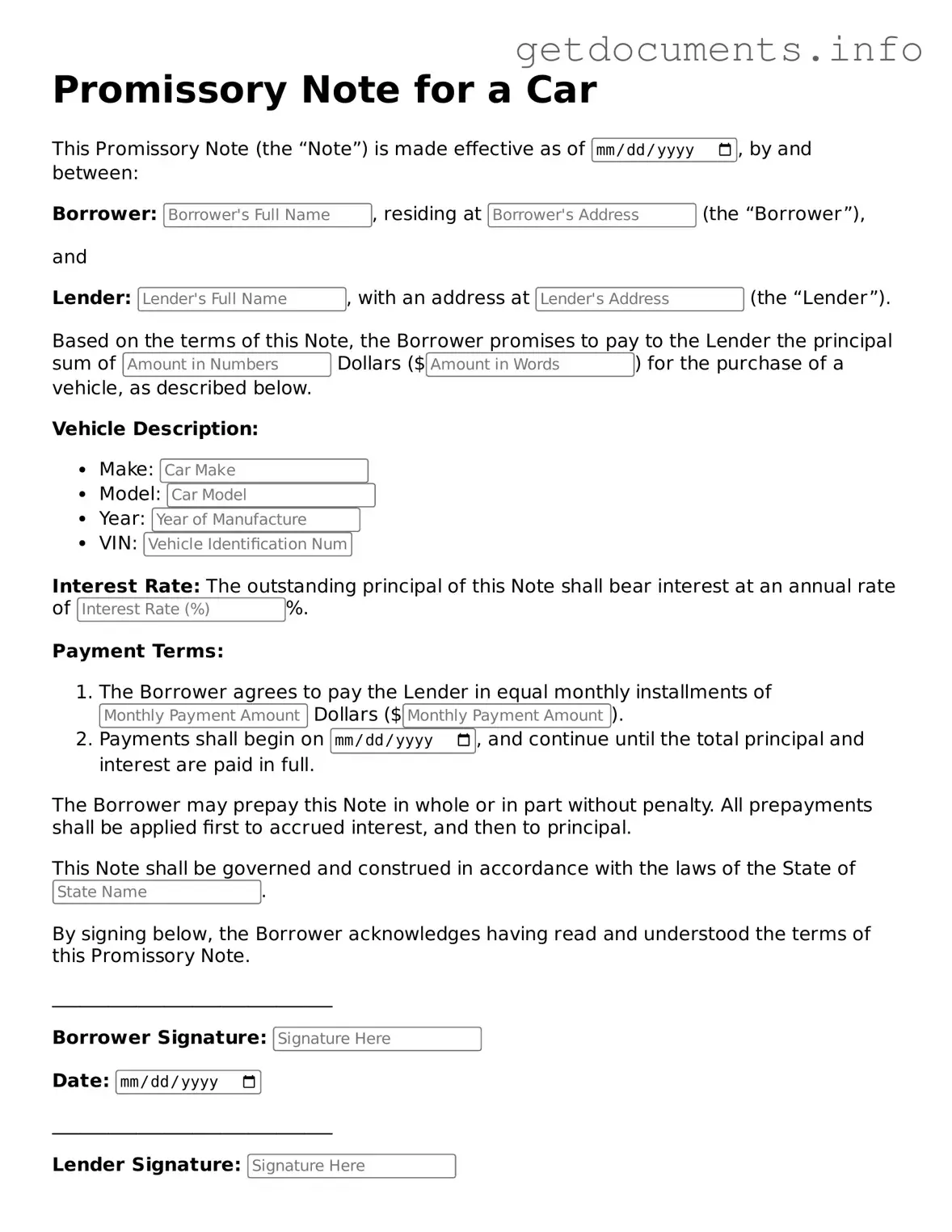

Printable Promissory Note for a Car Document

A Promissory Note for a Car is a legal document that outlines the terms under which a borrower agrees to repay a loan used to purchase a vehicle. This form serves as a written promise to pay a specified amount, detailing the interest rate, payment schedule, and consequences of default. Understanding this form is crucial for both buyers and sellers to ensure a smooth transaction.

Ready to fill out your Promissory Note for a Car? Click the button below to get started!

Access Promissory Note for a Car Editor

Printable Promissory Note for a Car Document

Access Promissory Note for a Car Editor

Got places to be? Complete the form fast

Fill out Promissory Note for a Car online and avoid printing or scanning.

Access Promissory Note for a Car Editor

or

⇩ PDF File