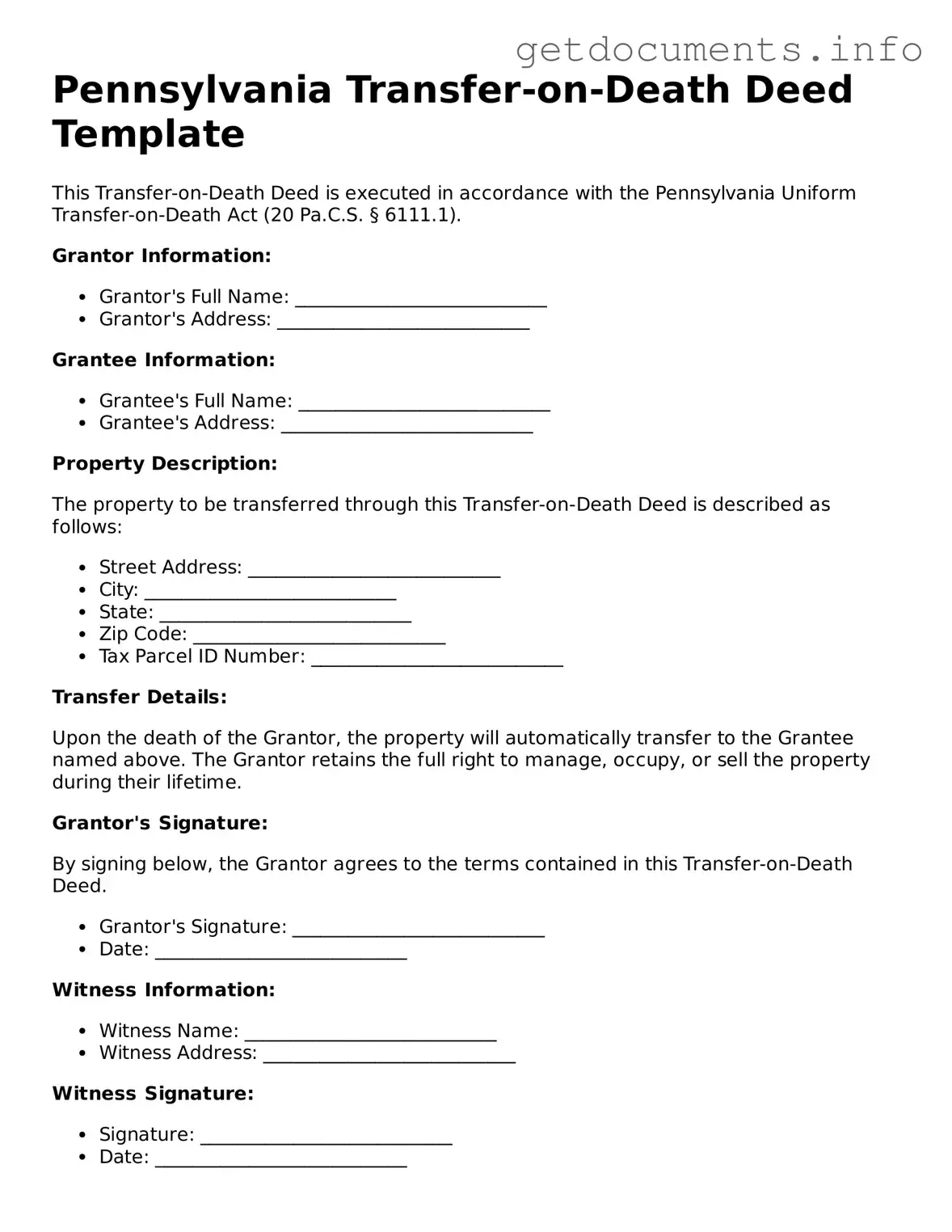

Free Transfer-on-Death Deed Template for Pennsylvania

The Pennsylvania Transfer-on-Death Deed form allows property owners to designate beneficiaries who will receive their real estate upon their death, bypassing the probate process. This straightforward legal tool ensures a smooth transition of property ownership while retaining full control during the owner’s lifetime. To begin the process of filling out the form, click the button below.

Access Transfer-on-Death Deed Editor

Free Transfer-on-Death Deed Template for Pennsylvania

Access Transfer-on-Death Deed Editor

Got places to be? Complete the form fast

Fill out Transfer-on-Death Deed online and avoid printing or scanning.

Access Transfer-on-Death Deed Editor

or

⇩ PDF File