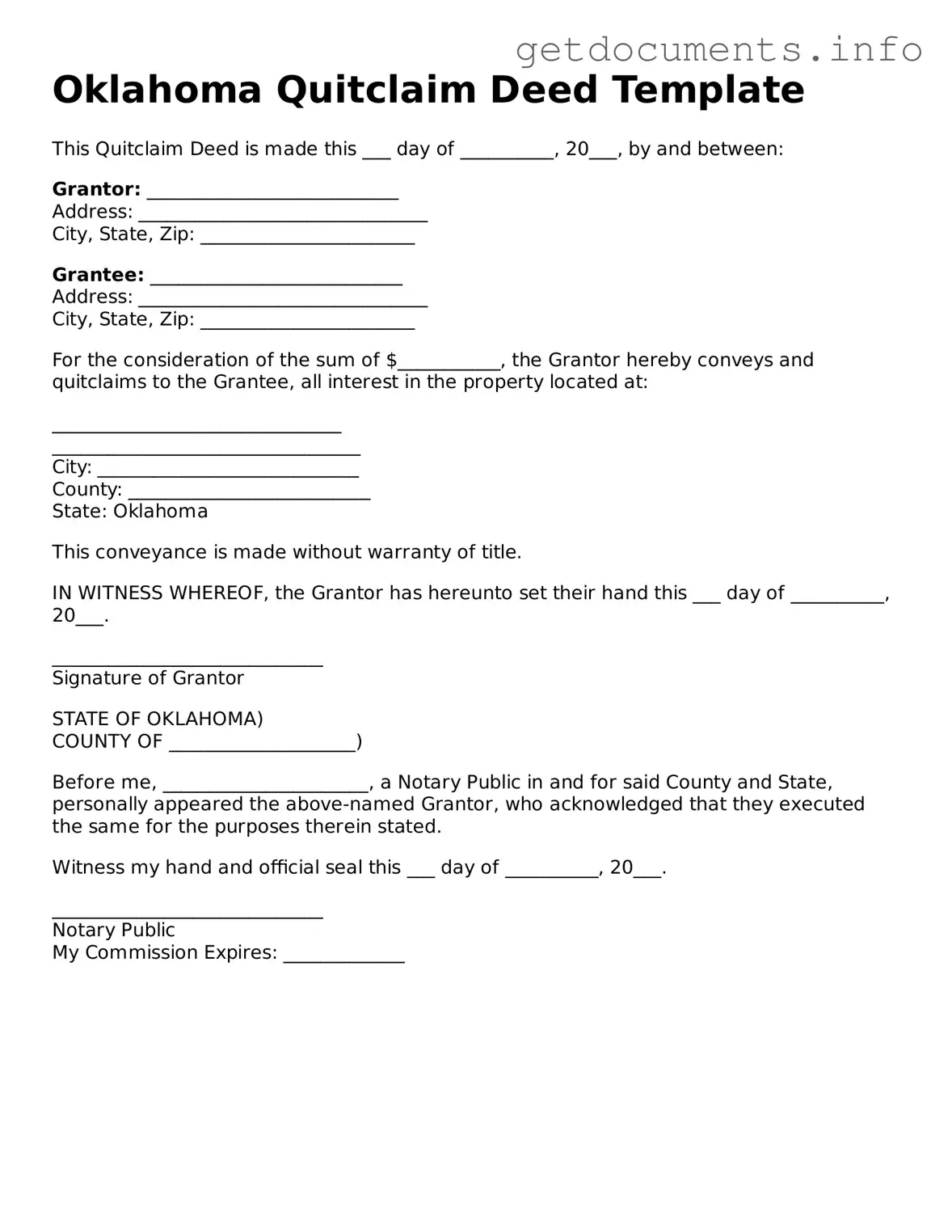

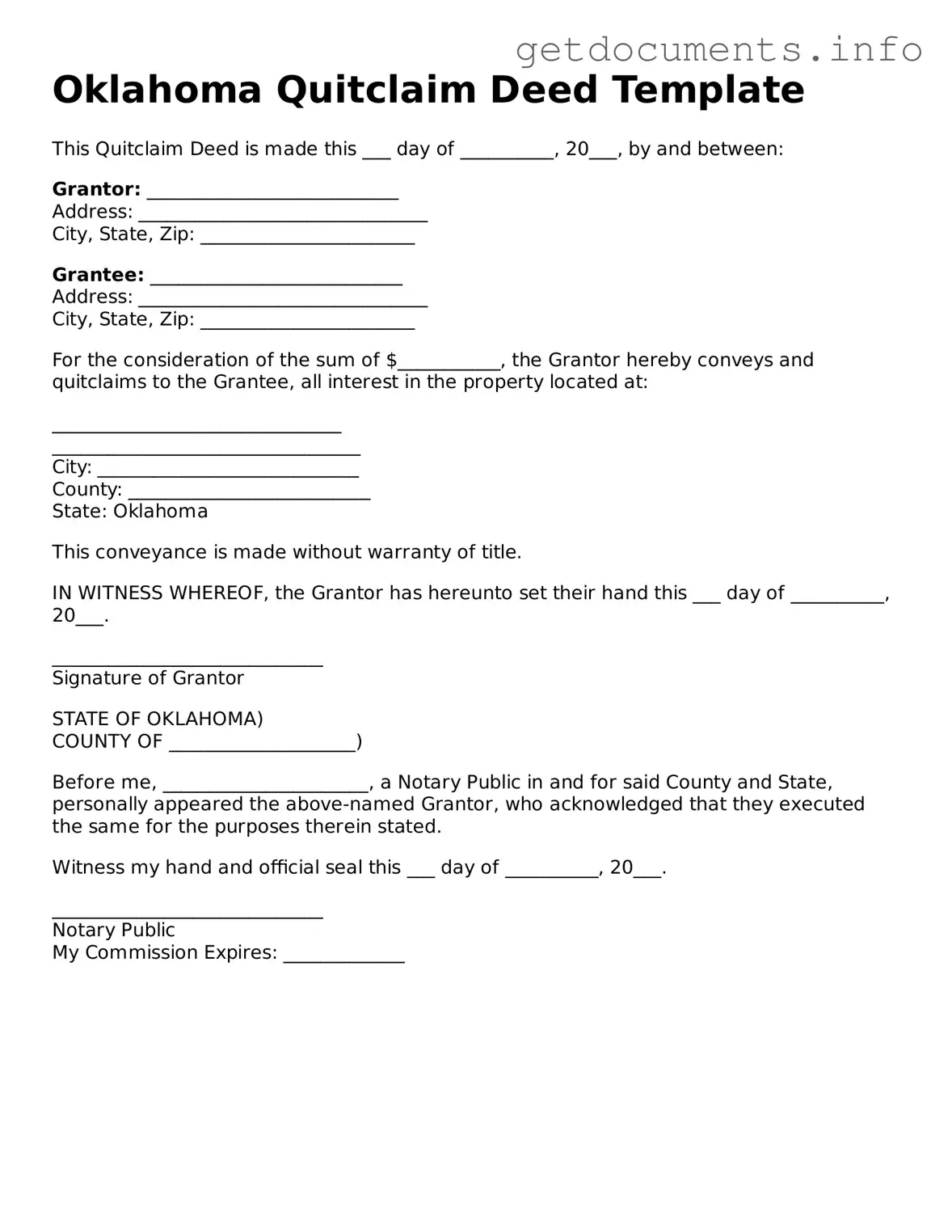

Free Quitclaim Deed Template for Oklahoma

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one person to another without guaranteeing that the property is free of claims or liens. This form is commonly used in Oklahoma for various purposes, including transferring property between family members or clearing up title issues. If you need to fill out a Quitclaim Deed, click the button below to get started.

Access Quitclaim Deed Editor

Free Quitclaim Deed Template for Oklahoma

Access Quitclaim Deed Editor

Got places to be? Complete the form fast

Fill out Quitclaim Deed online and avoid printing or scanning.

Access Quitclaim Deed Editor

or

⇩ PDF File