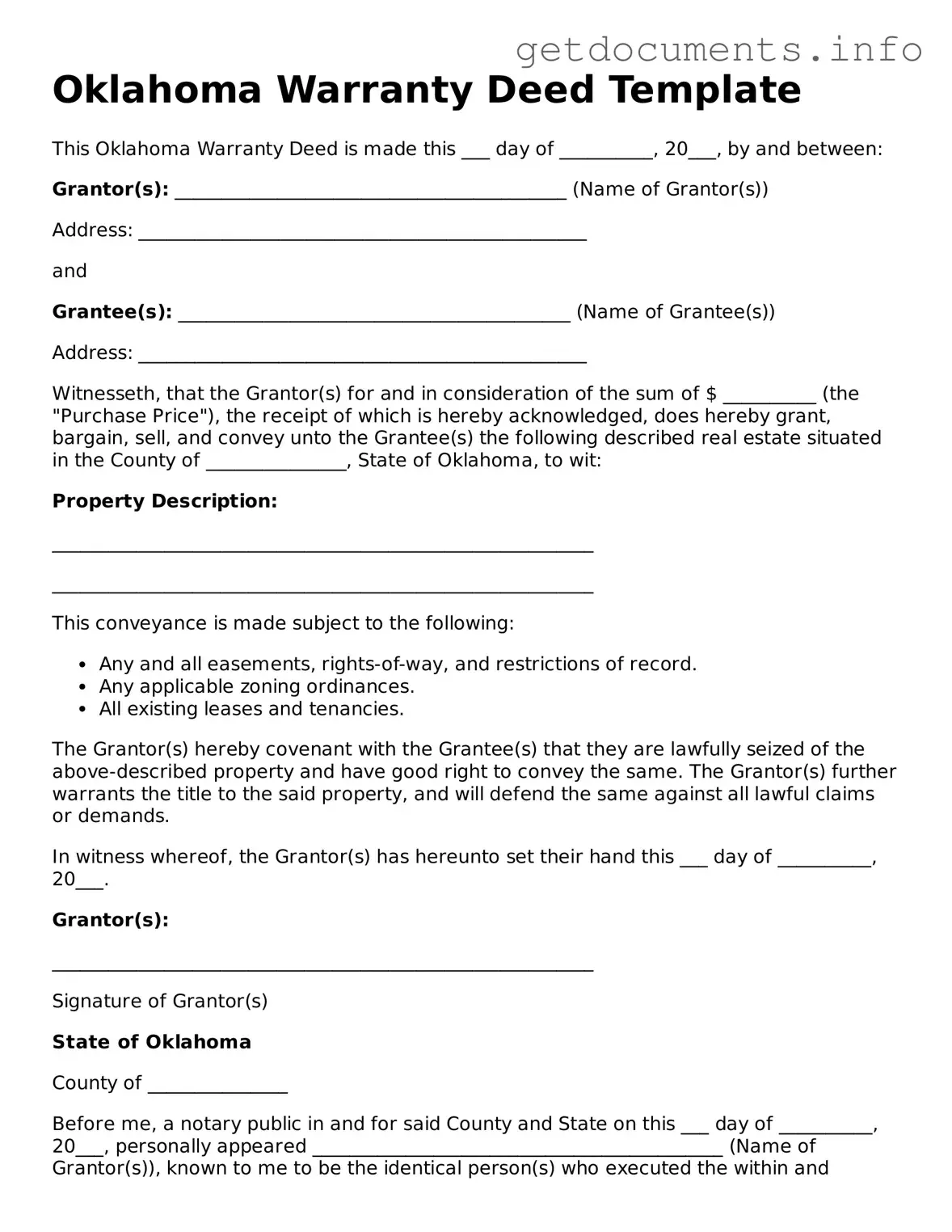

Free Deed Template for Oklahoma

A deed form in Oklahoma is a legal document used to transfer ownership of real estate from one party to another. This form outlines the details of the property being transferred and the parties involved in the transaction. To ensure a smooth transfer, consider filling out the Oklahoma Deed form by clicking the button below.

Access Deed Editor

Free Deed Template for Oklahoma

Access Deed Editor

Got places to be? Complete the form fast

Fill out Deed online and avoid printing or scanning.

Access Deed Editor

or

⇩ PDF File