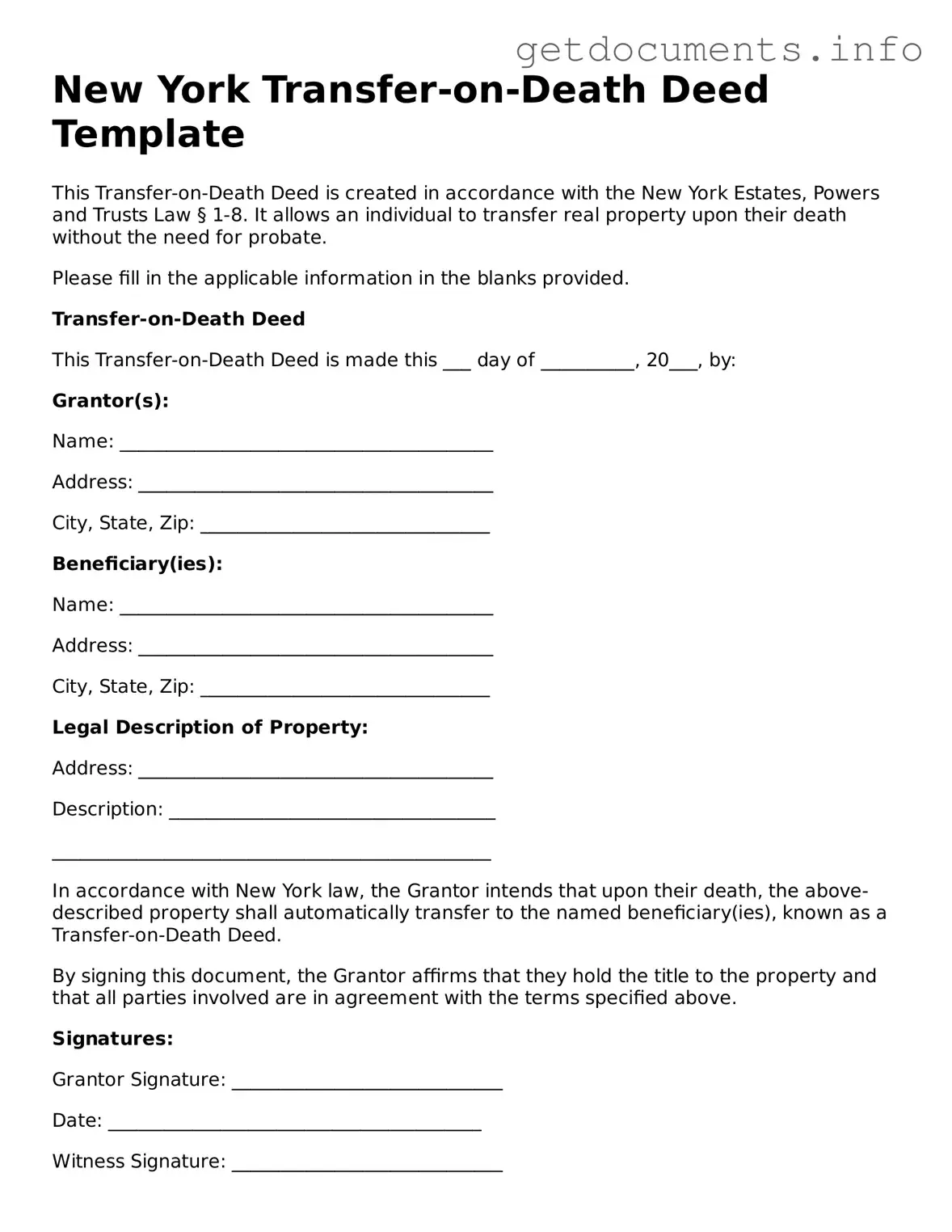

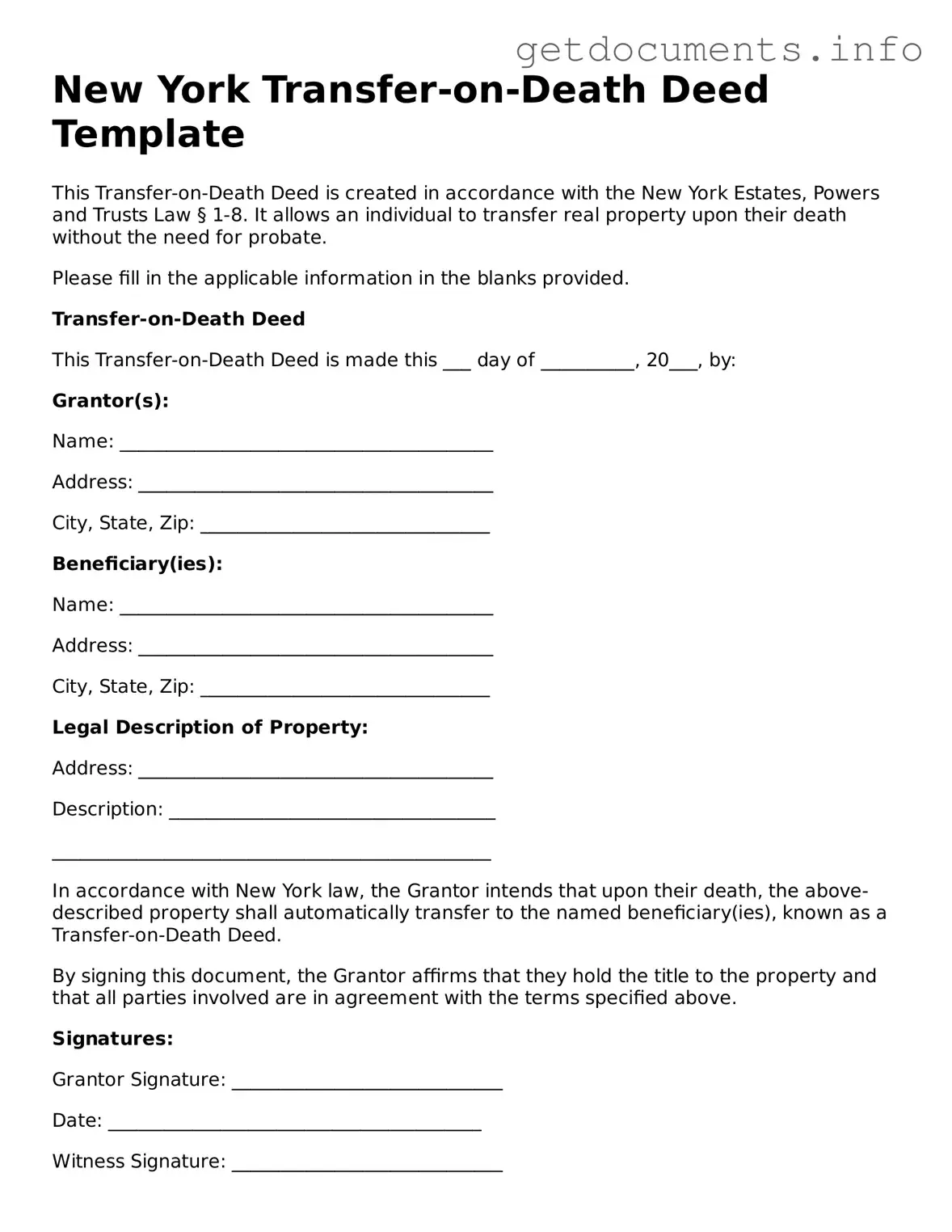

Free Transfer-on-Death Deed Template for New York

The New York Transfer-on-Death Deed form is a legal document that allows property owners to transfer their real estate to designated beneficiaries upon their death, bypassing the probate process. This form provides a straightforward way to ensure that your property goes to the people you choose, without the complications that often accompany inheritance. Ready to secure your property for your loved ones? Fill out the form by clicking the button below.

Access Transfer-on-Death Deed Editor

Free Transfer-on-Death Deed Template for New York

Access Transfer-on-Death Deed Editor

Got places to be? Complete the form fast

Fill out Transfer-on-Death Deed online and avoid printing or scanning.

Access Transfer-on-Death Deed Editor

or

⇩ PDF File