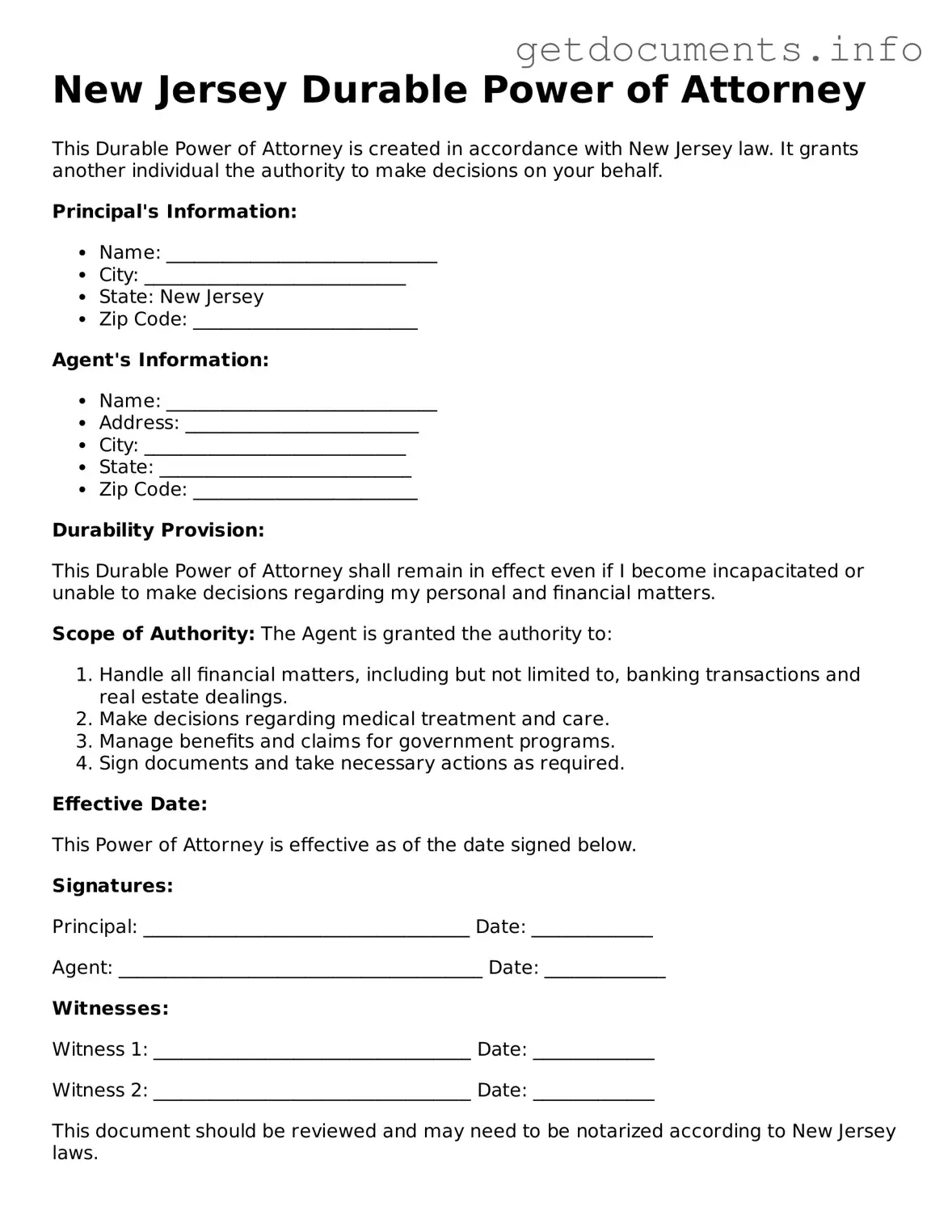

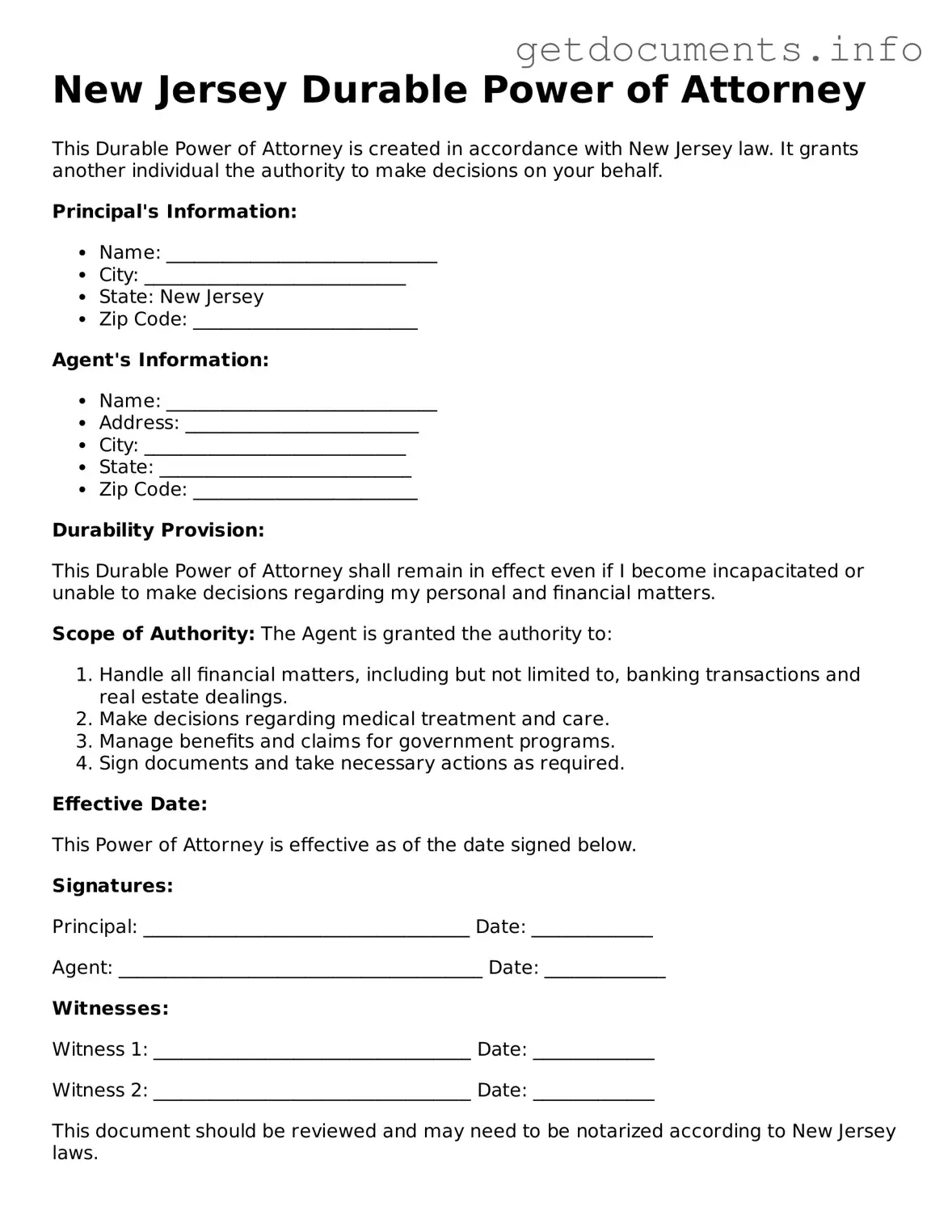

Free Durable Power of Attorney Template for New Jersey

A New Jersey Durable Power of Attorney form allows an individual to designate someone else to manage their financial and legal affairs if they become unable to do so themselves. This important legal document ensures that your wishes are honored and that someone you trust is in charge during difficult times. To get started on protecting your interests, fill out the form by clicking the button below.

Access Durable Power of Attorney Editor

Free Durable Power of Attorney Template for New Jersey

Access Durable Power of Attorney Editor

Got places to be? Complete the form fast

Fill out Durable Power of Attorney online and avoid printing or scanning.

Access Durable Power of Attorney Editor

or

⇩ PDF File