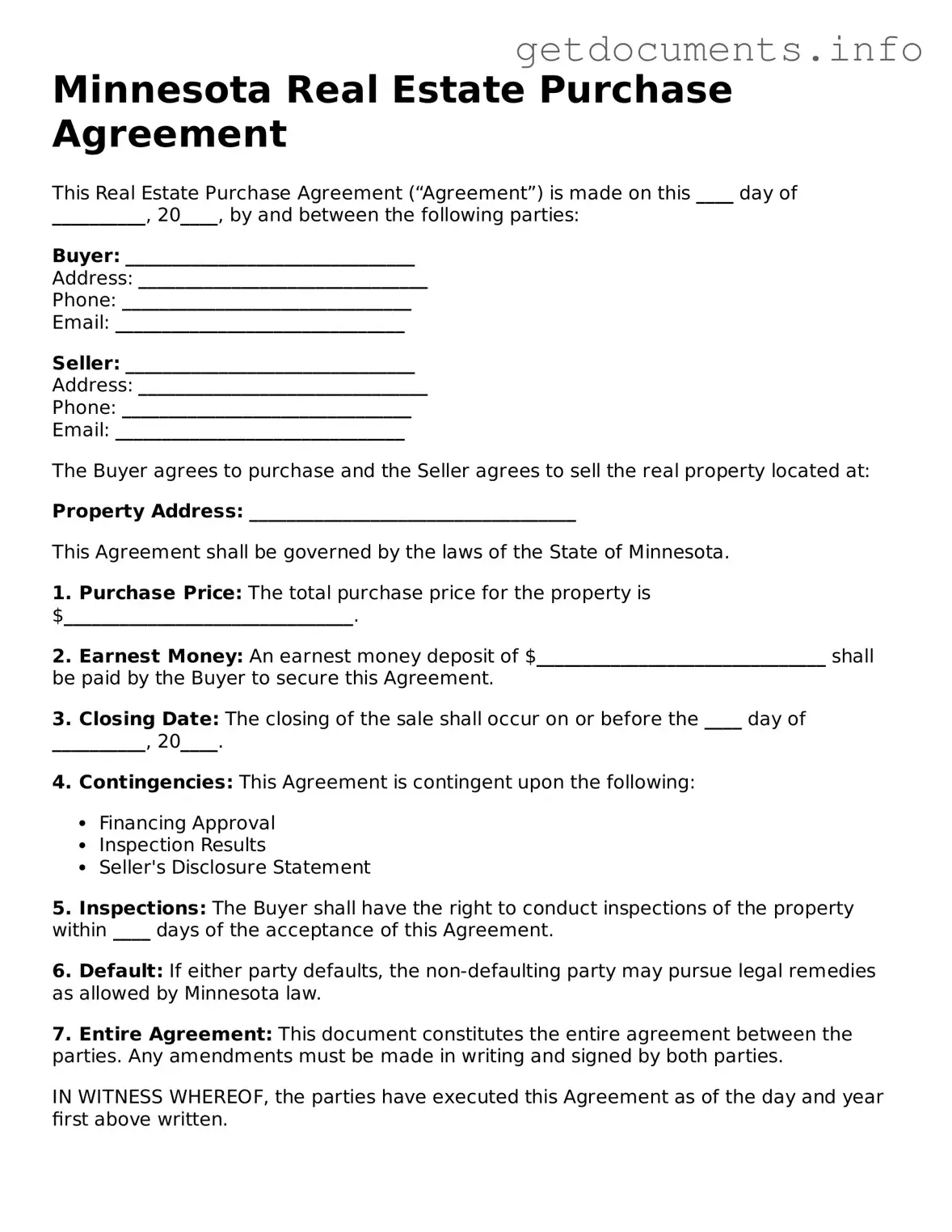

Free Real Estate Purchase Agreement Template for Minnesota

The Minnesota Real Estate Purchase Agreement is a vital document that outlines the terms and conditions under which a property is bought and sold in the state. This form serves as a legally binding contract between the buyer and seller, ensuring that both parties understand their rights and obligations. If you're ready to take the next step in your real estate journey, fill out the form by clicking the button below.

Access Real Estate Purchase Agreement Editor

Free Real Estate Purchase Agreement Template for Minnesota

Access Real Estate Purchase Agreement Editor

Got places to be? Complete the form fast

Fill out Real Estate Purchase Agreement online and avoid printing or scanning.

Access Real Estate Purchase Agreement Editor

or

⇩ PDF File