Free Motor Vehicle Bill of Sale Template for Minnesota

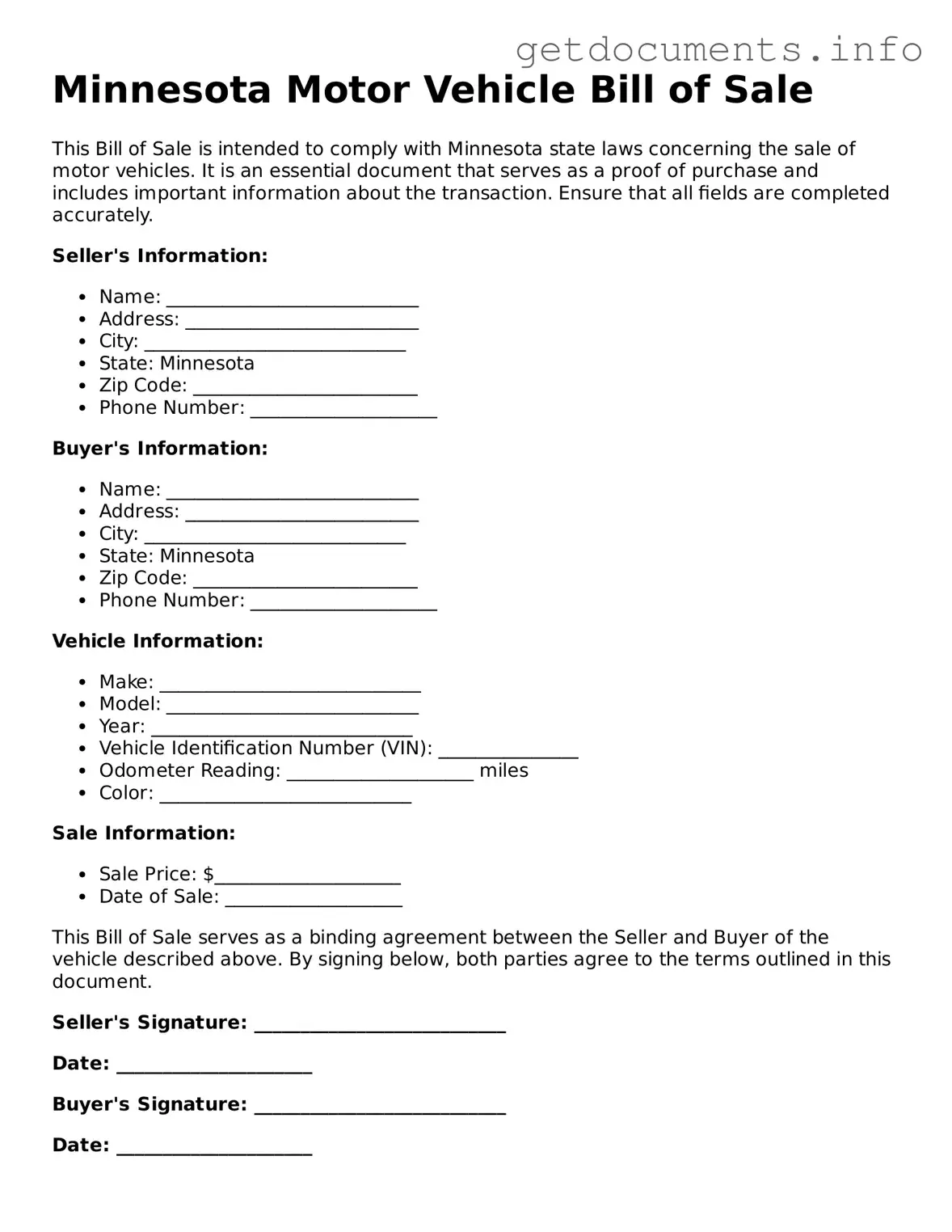

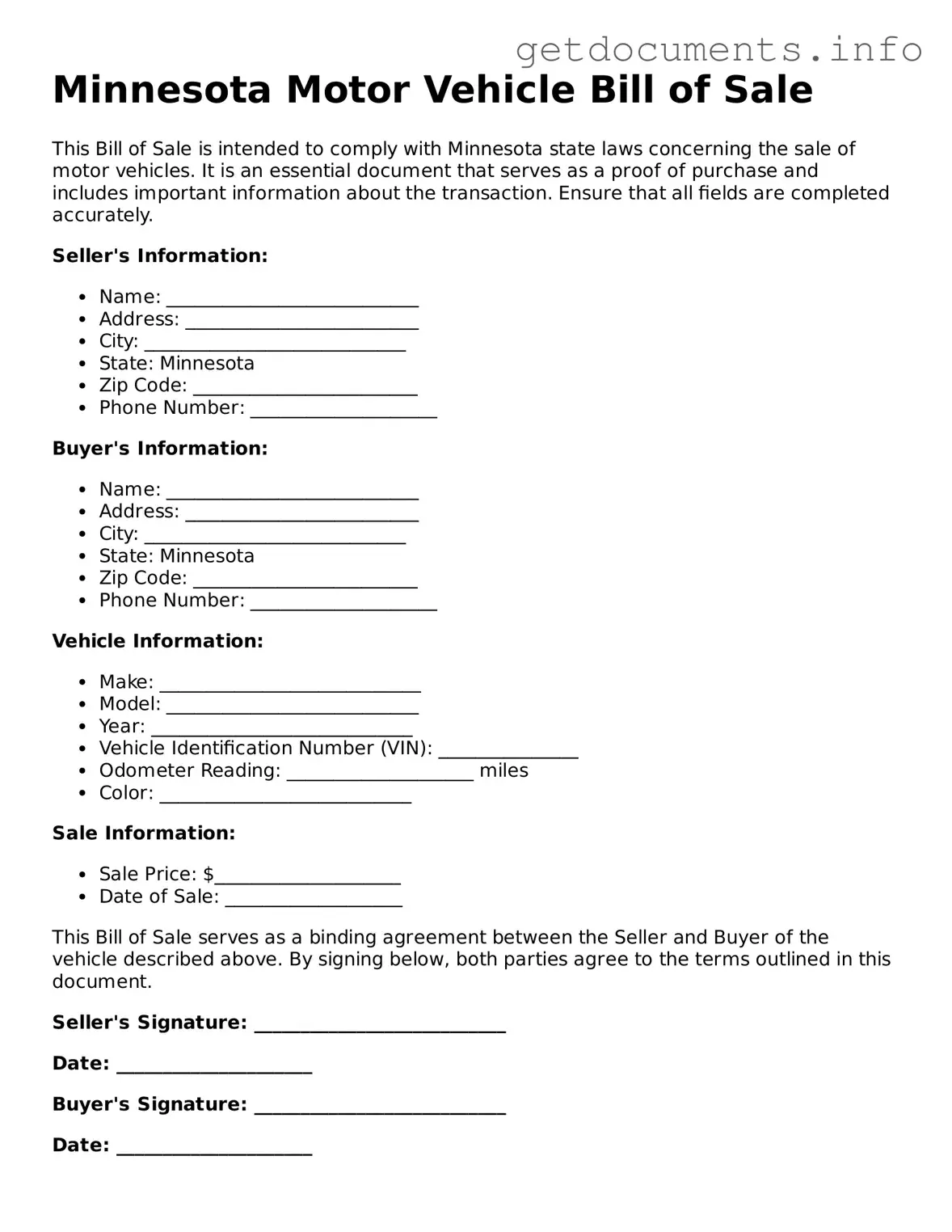

The Minnesota Motor Vehicle Bill of Sale form is a legal document used to record the sale of a motor vehicle between a seller and a buyer. This form serves as proof of the transaction and includes important details such as the vehicle's identification number, sale price, and the parties involved. To ensure a smooth transfer of ownership, it is essential to fill out the form accurately.

Start the process by filling out the form below.

Access Motor Vehicle Bill of Sale Editor

Free Motor Vehicle Bill of Sale Template for Minnesota

Access Motor Vehicle Bill of Sale Editor

Got places to be? Complete the form fast

Fill out Motor Vehicle Bill of Sale online and avoid printing or scanning.

Access Motor Vehicle Bill of Sale Editor

or

⇩ PDF File