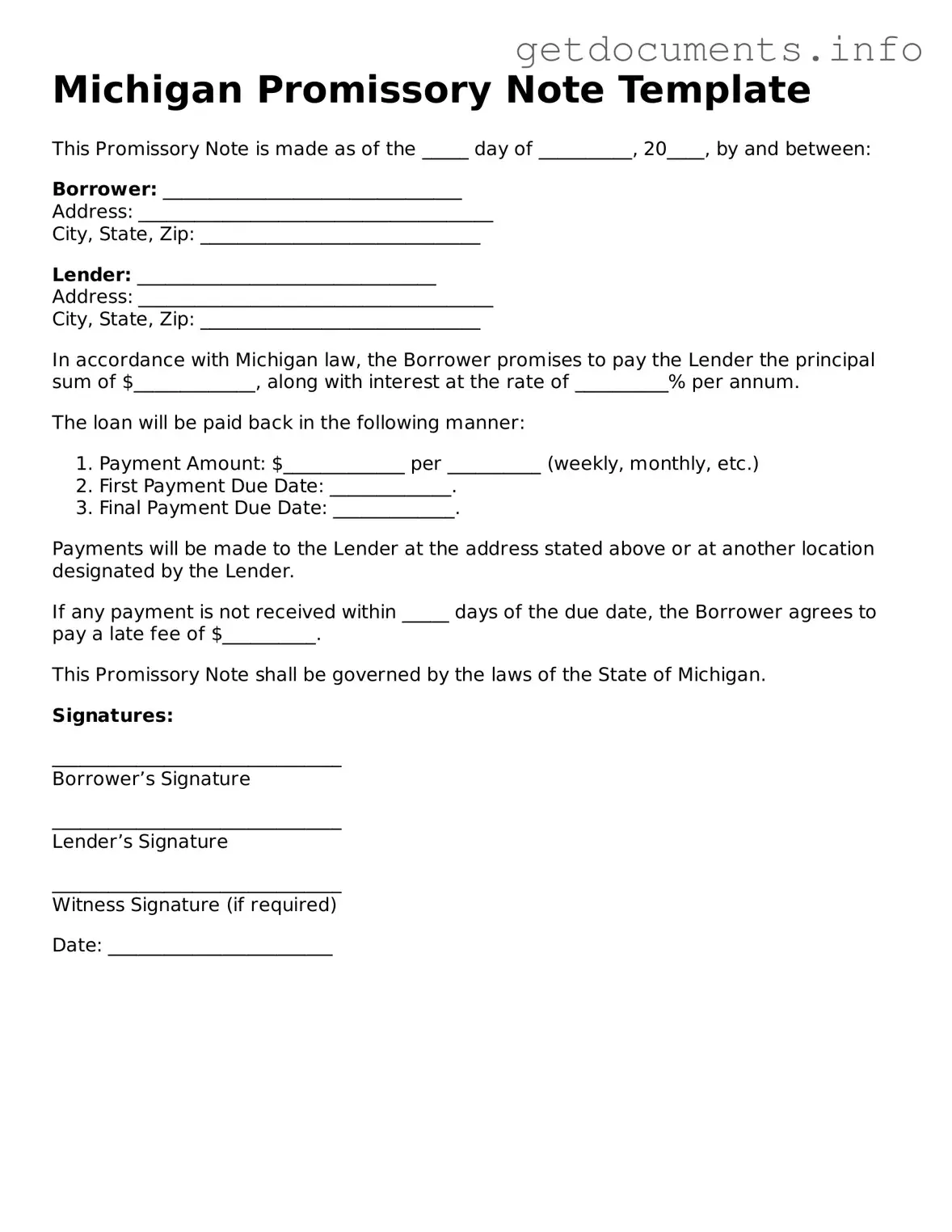

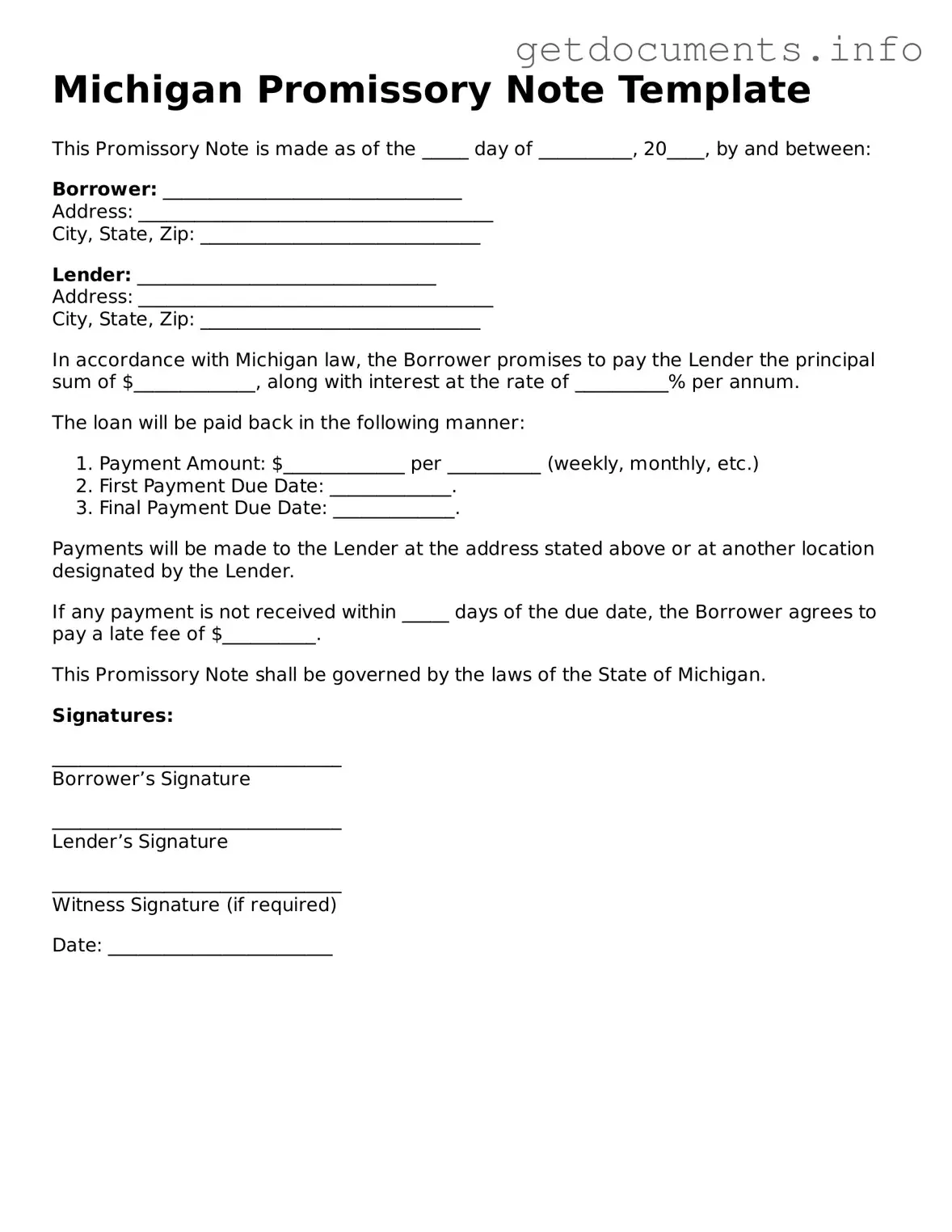

Free Promissory Note Template for Michigan

A Michigan Promissory Note is a written promise to pay a specified amount of money to a lender at a defined time or on demand. This document serves as a legal record of the debt and outlines the terms of repayment. For those interested in securing a loan or lending money, completing this form is an essential step; click the button below to get started.

Access Promissory Note Editor

Free Promissory Note Template for Michigan

Access Promissory Note Editor

Got places to be? Complete the form fast

Fill out Promissory Note online and avoid printing or scanning.

Access Promissory Note Editor

or

⇩ PDF File