Free Deed Template for Michigan

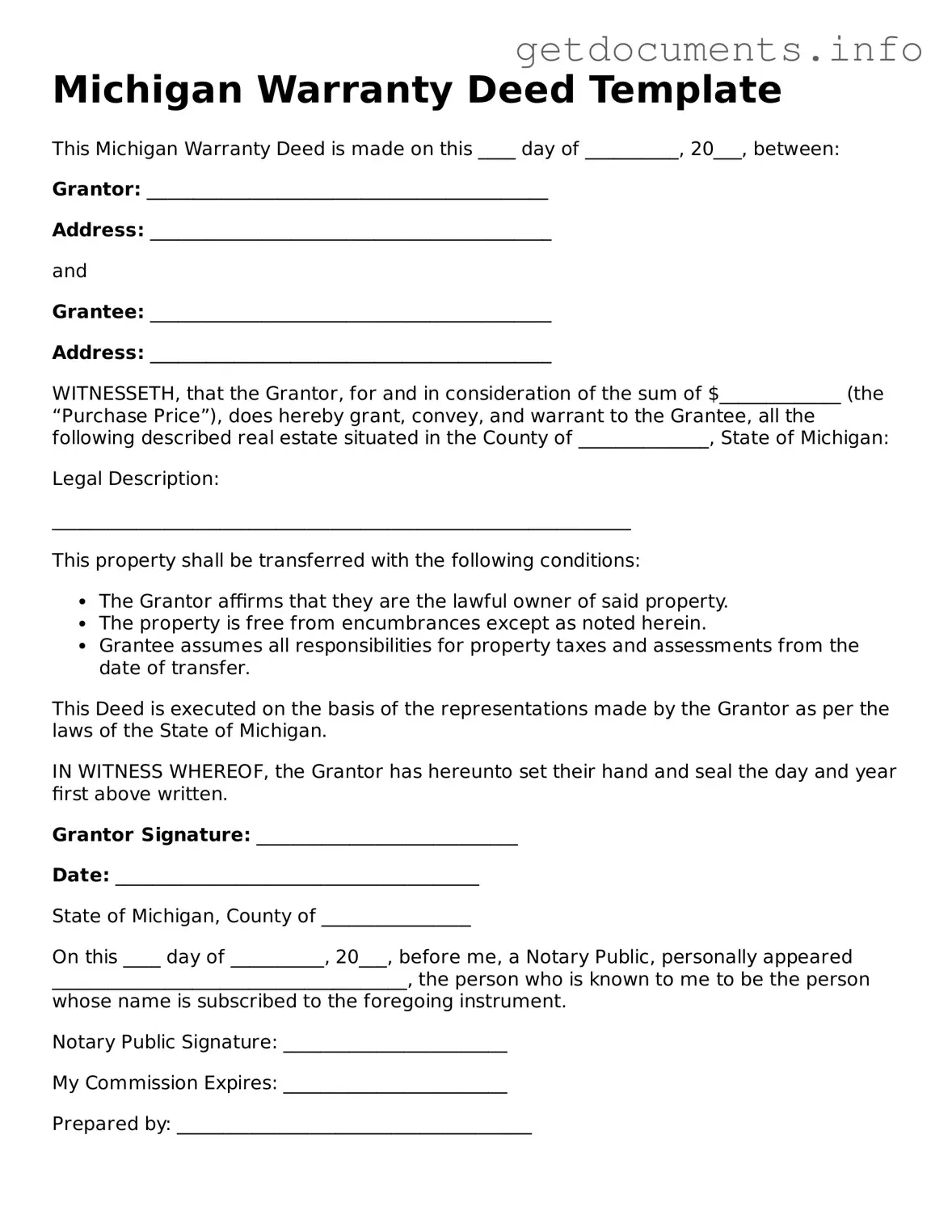

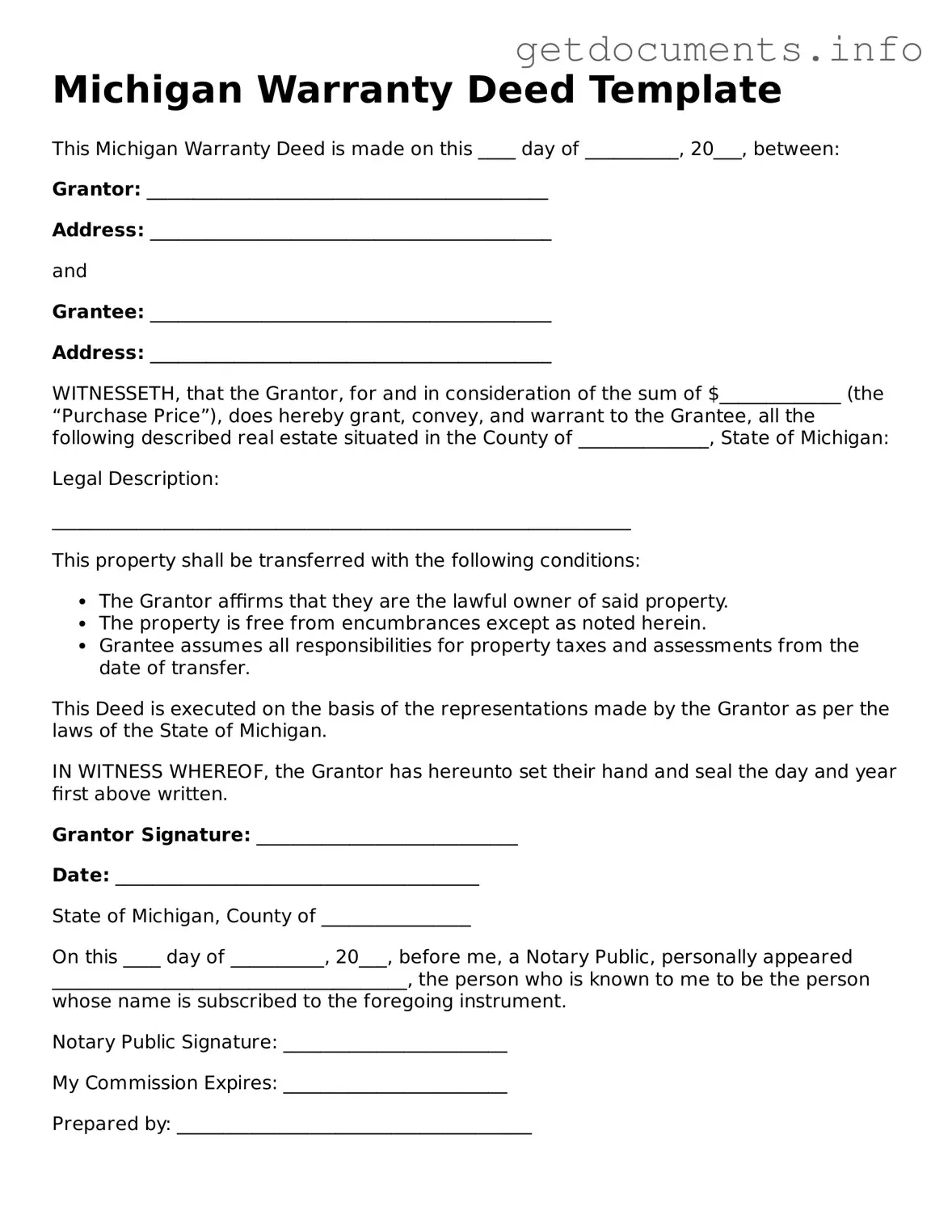

A Michigan Deed form is a legal document used to transfer ownership of real property from one party to another. This form ensures that the transaction is recorded and recognized by the state, providing a clear chain of title. To begin the process of transferring property ownership, please fill out the form by clicking the button below.

Access Deed Editor

Free Deed Template for Michigan

Access Deed Editor

Got places to be? Complete the form fast

Fill out Deed online and avoid printing or scanning.

Access Deed Editor

or

⇩ PDF File