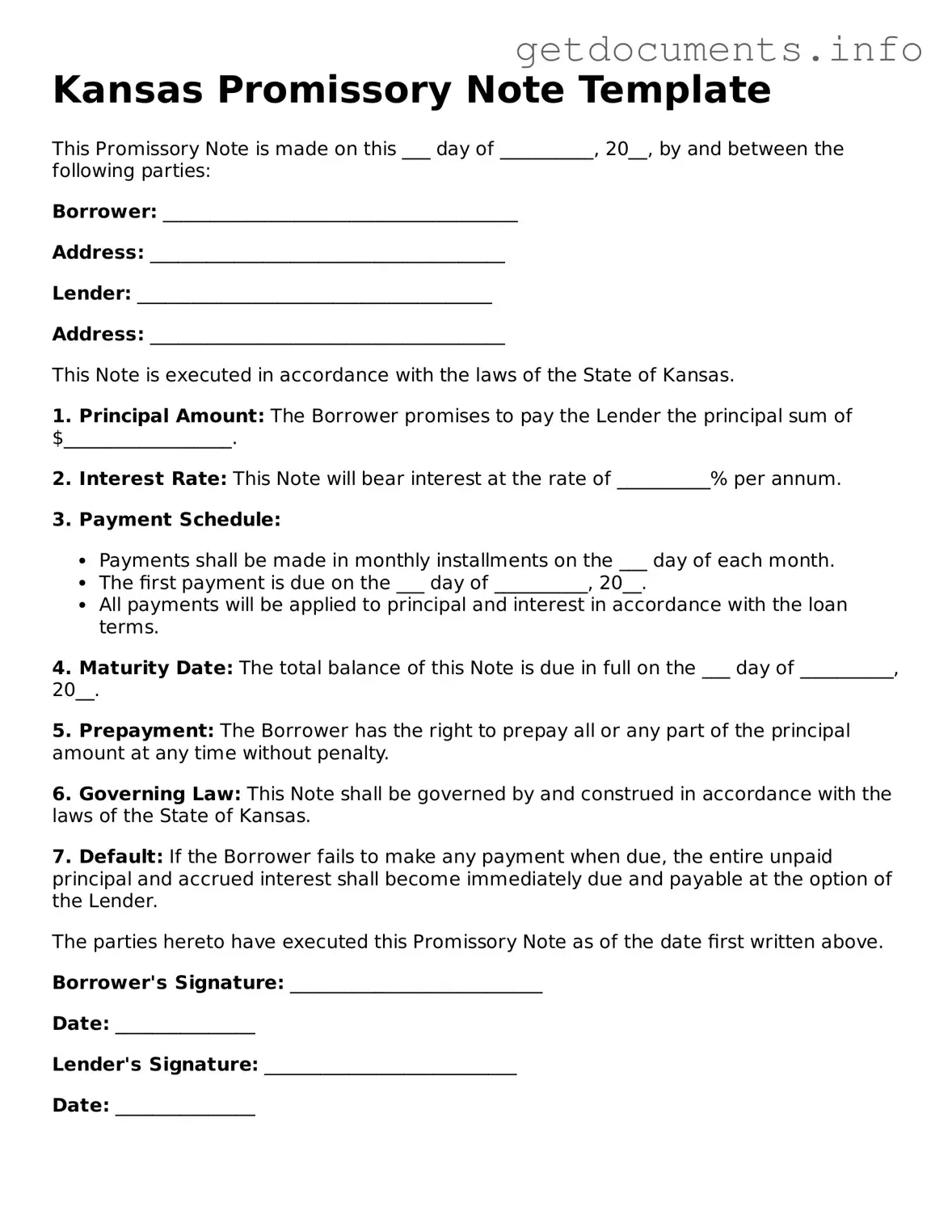

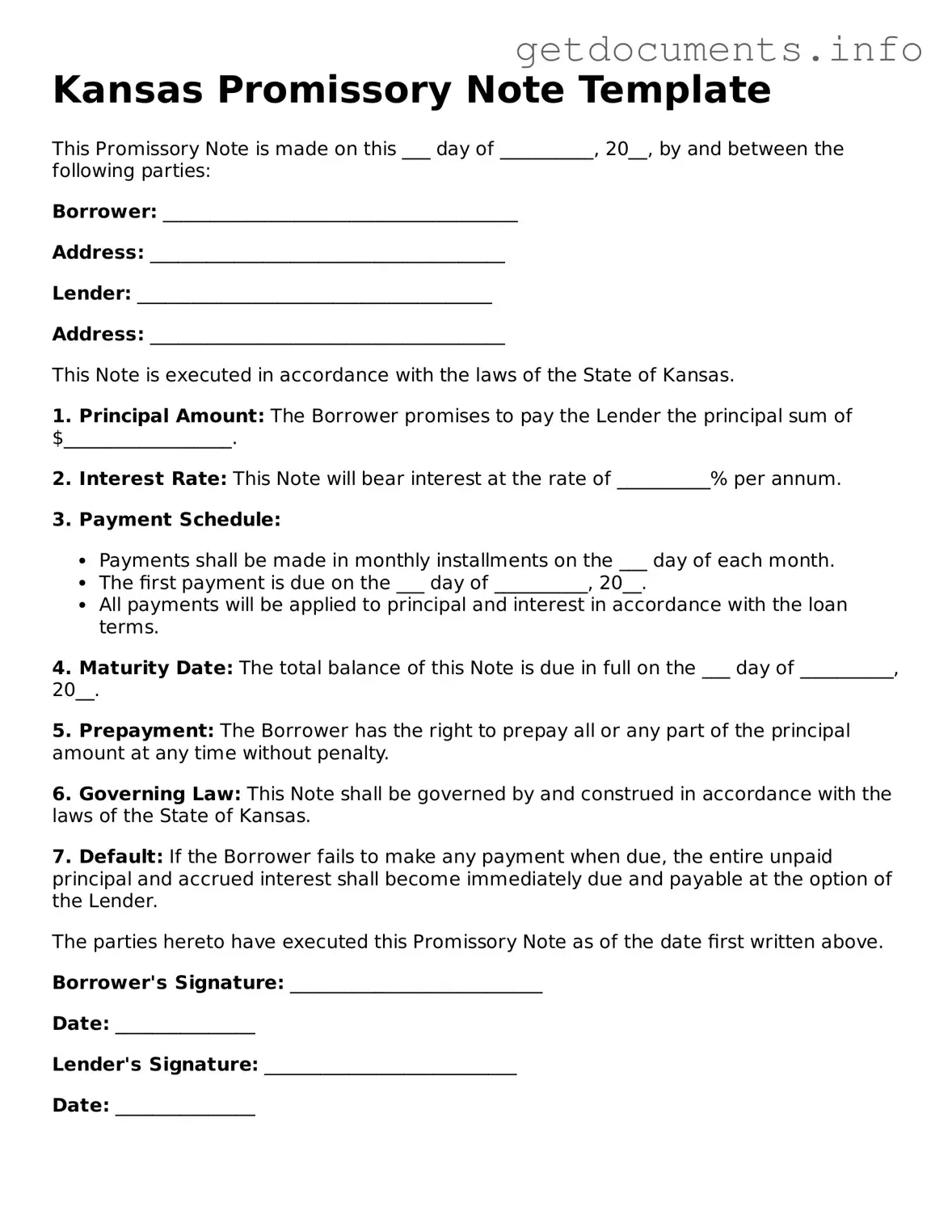

Free Promissory Note Template for Kansas

A Kansas Promissory Note is a written promise to pay a specified amount of money to a designated party at a future date or on demand. This legal document serves as a crucial tool for individuals and businesses to formalize loans and financial agreements. If you need to create a Kansas Promissory Note, take the first step by filling out the form below.

Access Promissory Note Editor

Free Promissory Note Template for Kansas

Access Promissory Note Editor

Got places to be? Complete the form fast

Fill out Promissory Note online and avoid printing or scanning.

Access Promissory Note Editor

or

⇩ PDF File