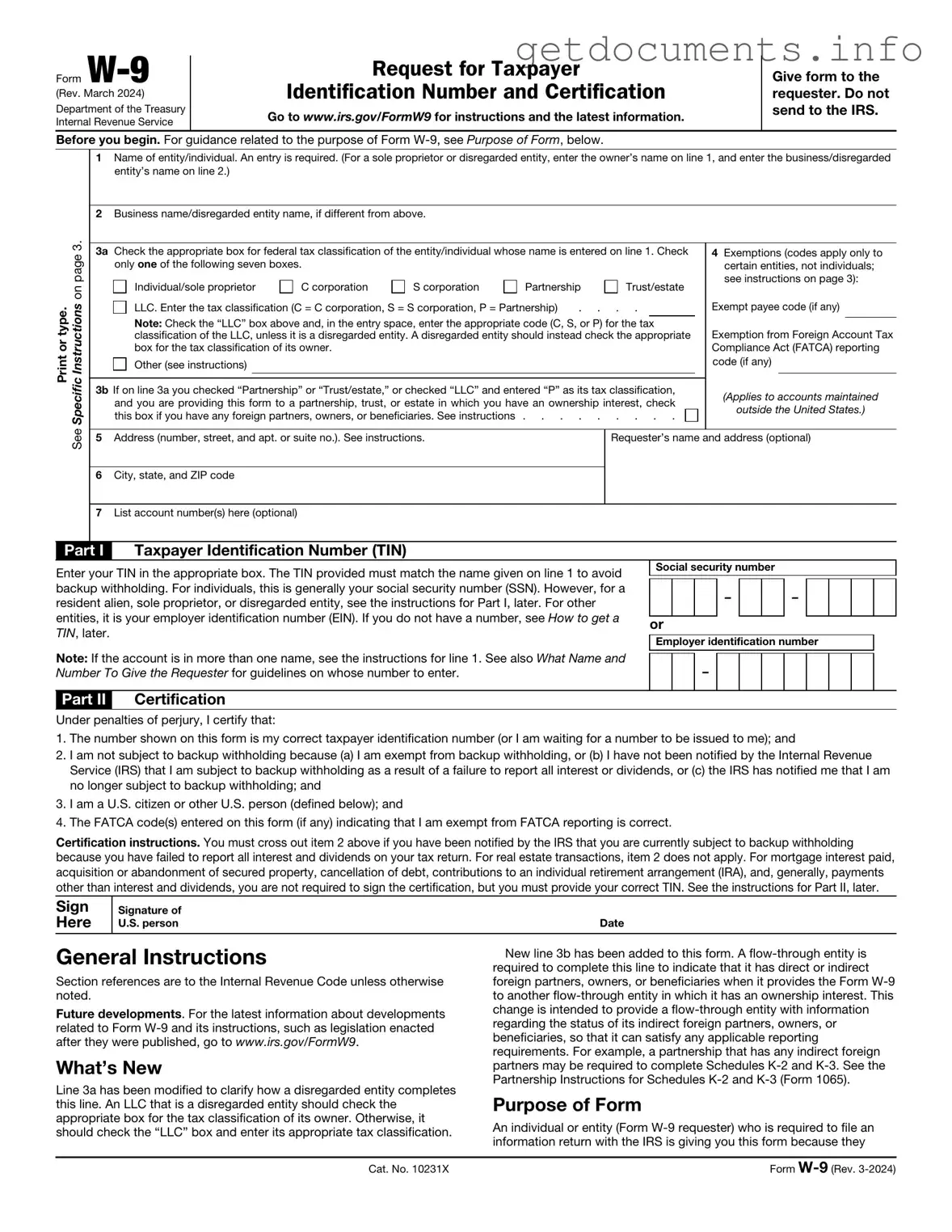

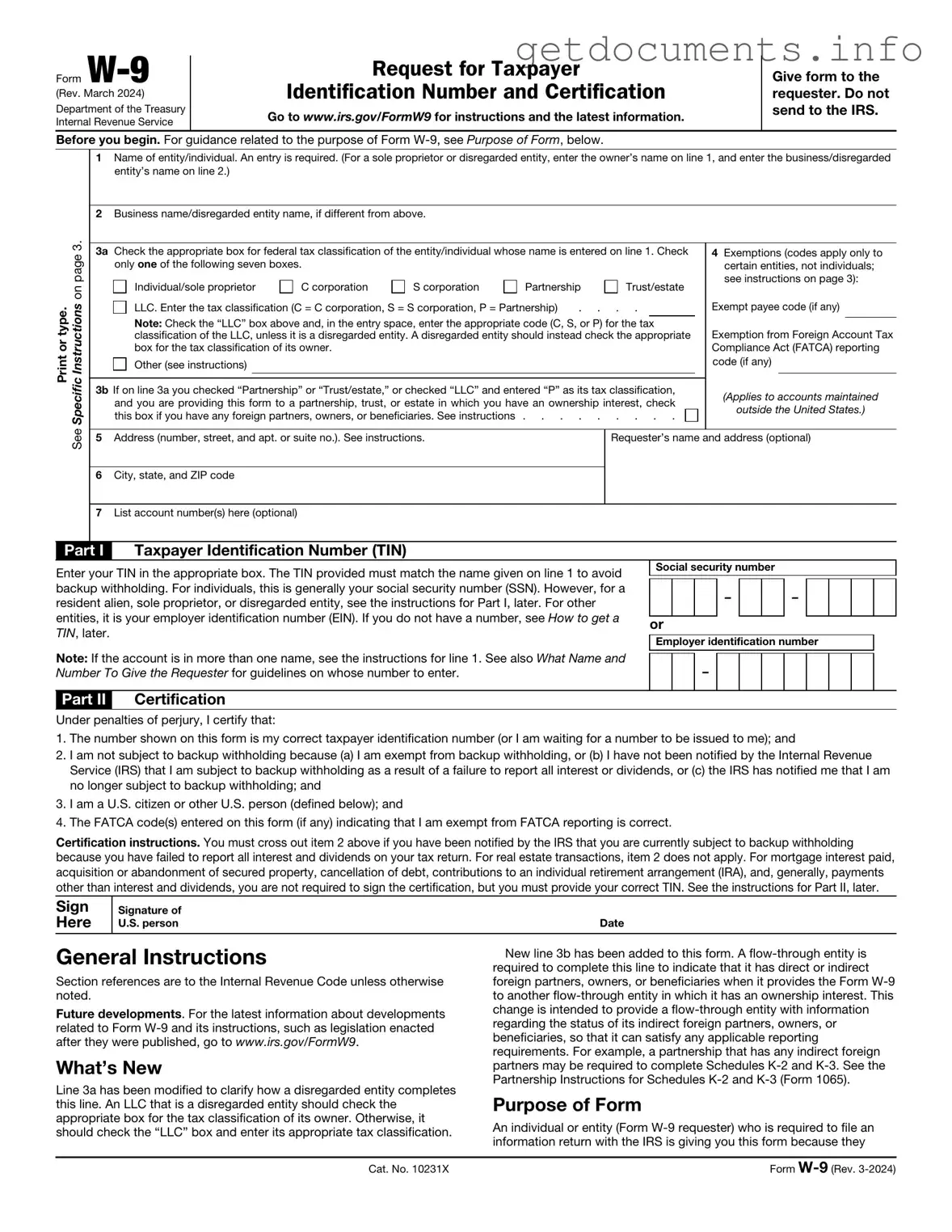

Official IRS W-9 Form

The IRS W-9 form is a document used by individuals and businesses to provide their taxpayer identification information to others, typically for tax purposes. Completing this form is essential for ensuring accurate reporting of income and taxes. Start the process of filling out your W-9 form today by clicking the button below.

Access IRS W-9 Editor

Official IRS W-9 Form

Access IRS W-9 Editor

Got places to be? Complete the form fast

Fill out IRS W-9 online and avoid printing or scanning.

Access IRS W-9 Editor

or

⇩ PDF File