Free Bill of Sale Template for Illinois

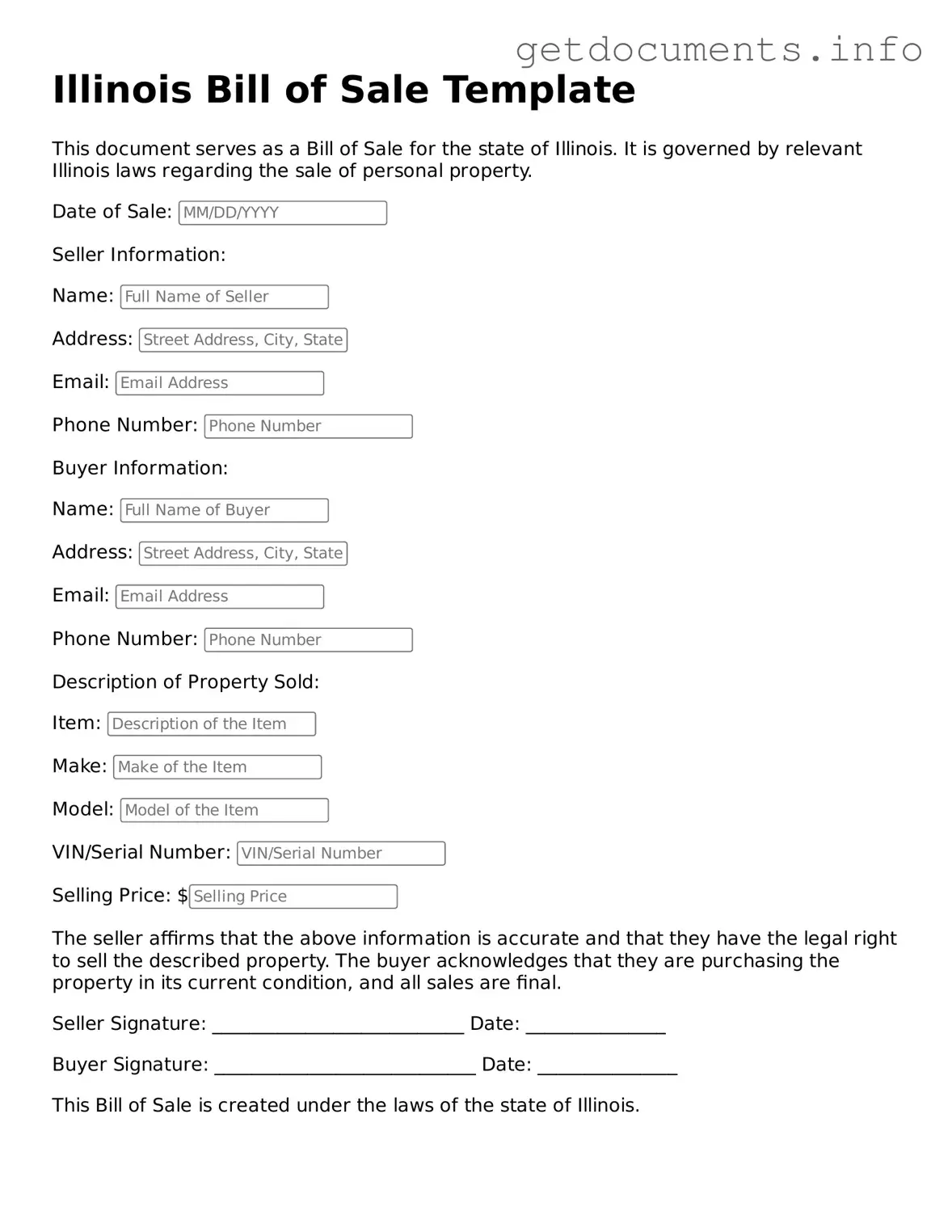

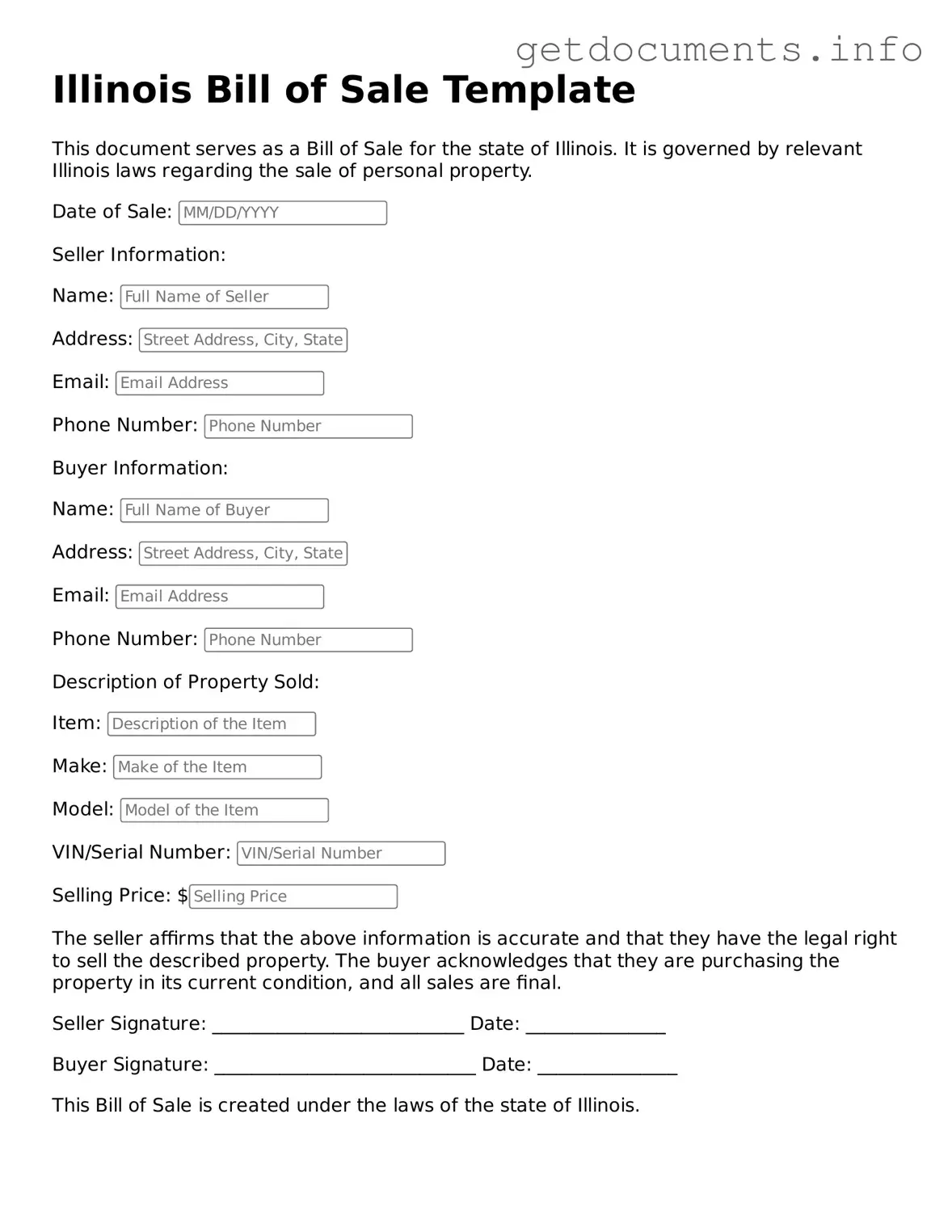

The Illinois Bill of Sale form is a legal document that serves as a receipt for the transfer of ownership of personal property from one individual to another. This form provides essential details about the transaction, including the buyer and seller's information, a description of the item being sold, and the sale price. To ensure a smooth transfer, it’s important to fill out this form accurately, so click the button below to get started.

Access Bill of Sale Editor

Free Bill of Sale Template for Illinois

Access Bill of Sale Editor

Got places to be? Complete the form fast

Fill out Bill of Sale online and avoid printing or scanning.

Access Bill of Sale Editor

or

⇩ PDF File