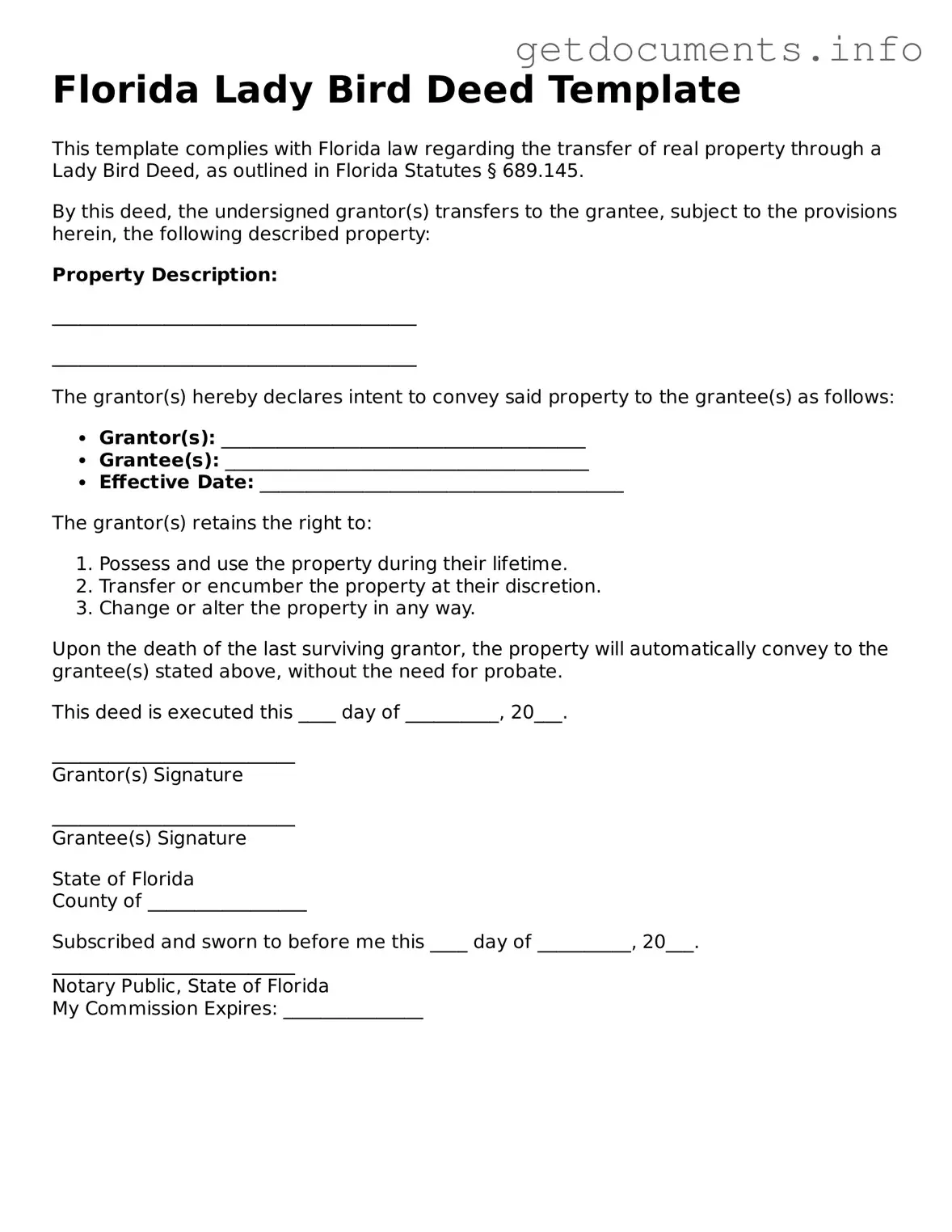

Free Lady Bird Deed Template for Florida

The Florida Lady Bird Deed is a legal document that allows property owners to transfer their real estate to beneficiaries while retaining control during their lifetime. This deed offers unique advantages, including the ability to avoid probate and maintain eligibility for certain benefits. Understanding its features can help ensure a smooth transition of property ownership.

Ready to take the next step? Fill out the form by clicking the button below.

Access Lady Bird Deed Editor

Free Lady Bird Deed Template for Florida

Access Lady Bird Deed Editor

Got places to be? Complete the form fast

Fill out Lady Bird Deed online and avoid printing or scanning.

Access Lady Bird Deed Editor

or

⇩ PDF File