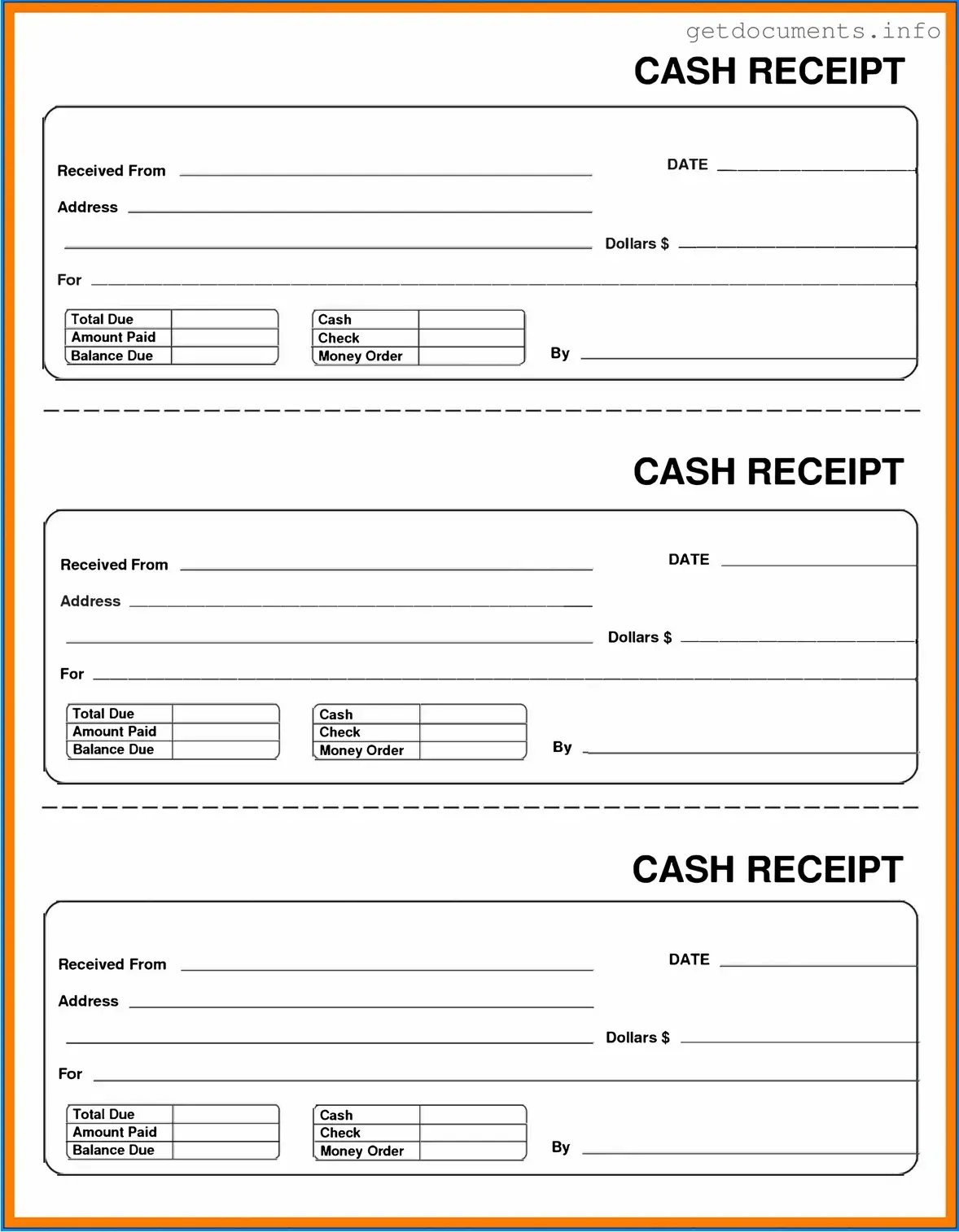

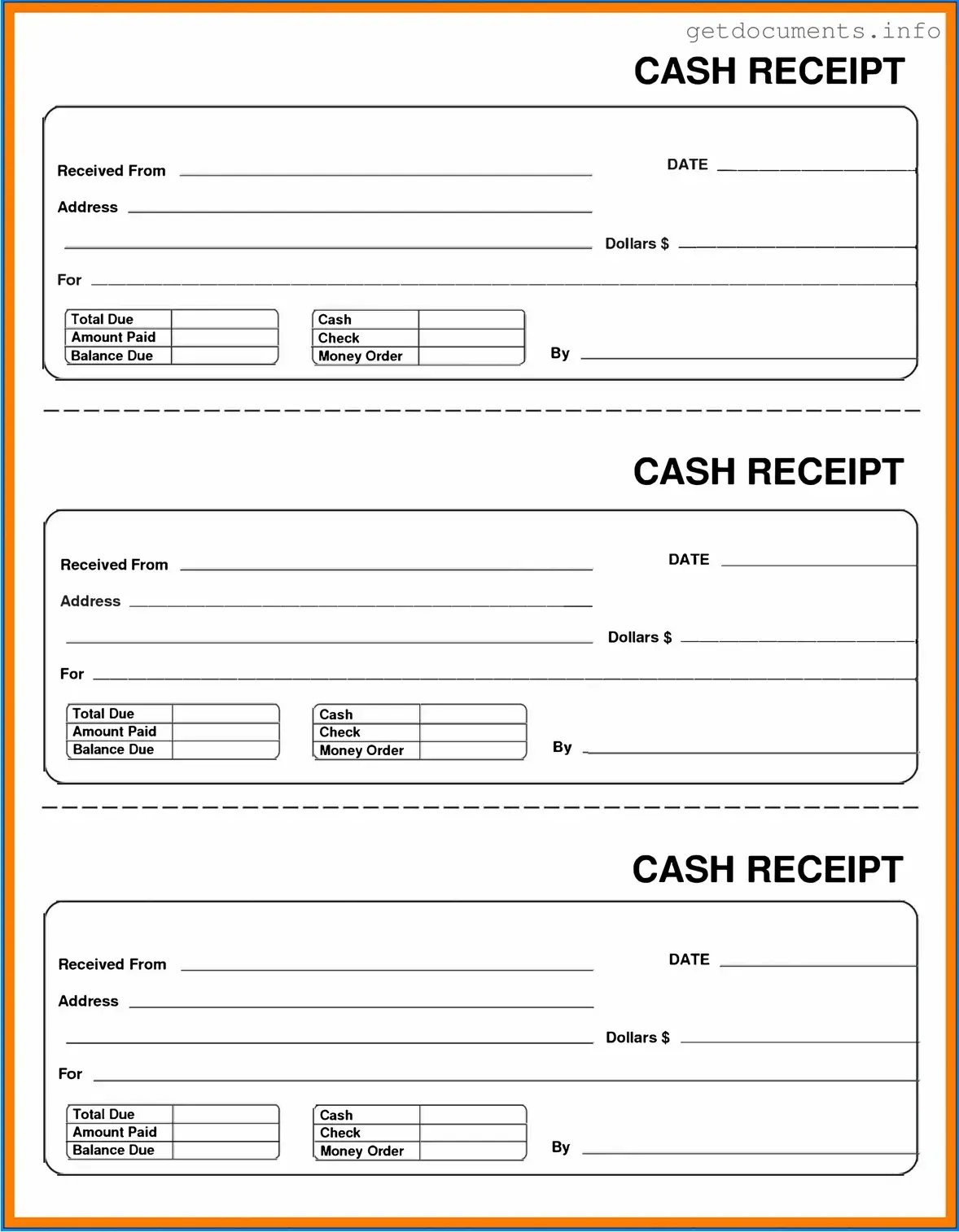

Official Cash Receipt Form

A Cash Receipt form is a vital document used to acknowledge the receipt of cash payments for goods or services. This form serves not only as proof of transaction but also helps maintain accurate financial records. To streamline your financial processes, consider filling out the Cash Receipt form by clicking the button below.

Access Cash Receipt Editor

Official Cash Receipt Form

Access Cash Receipt Editor

Got places to be? Complete the form fast

Fill out Cash Receipt online and avoid printing or scanning.

Access Cash Receipt Editor

or

⇩ PDF File