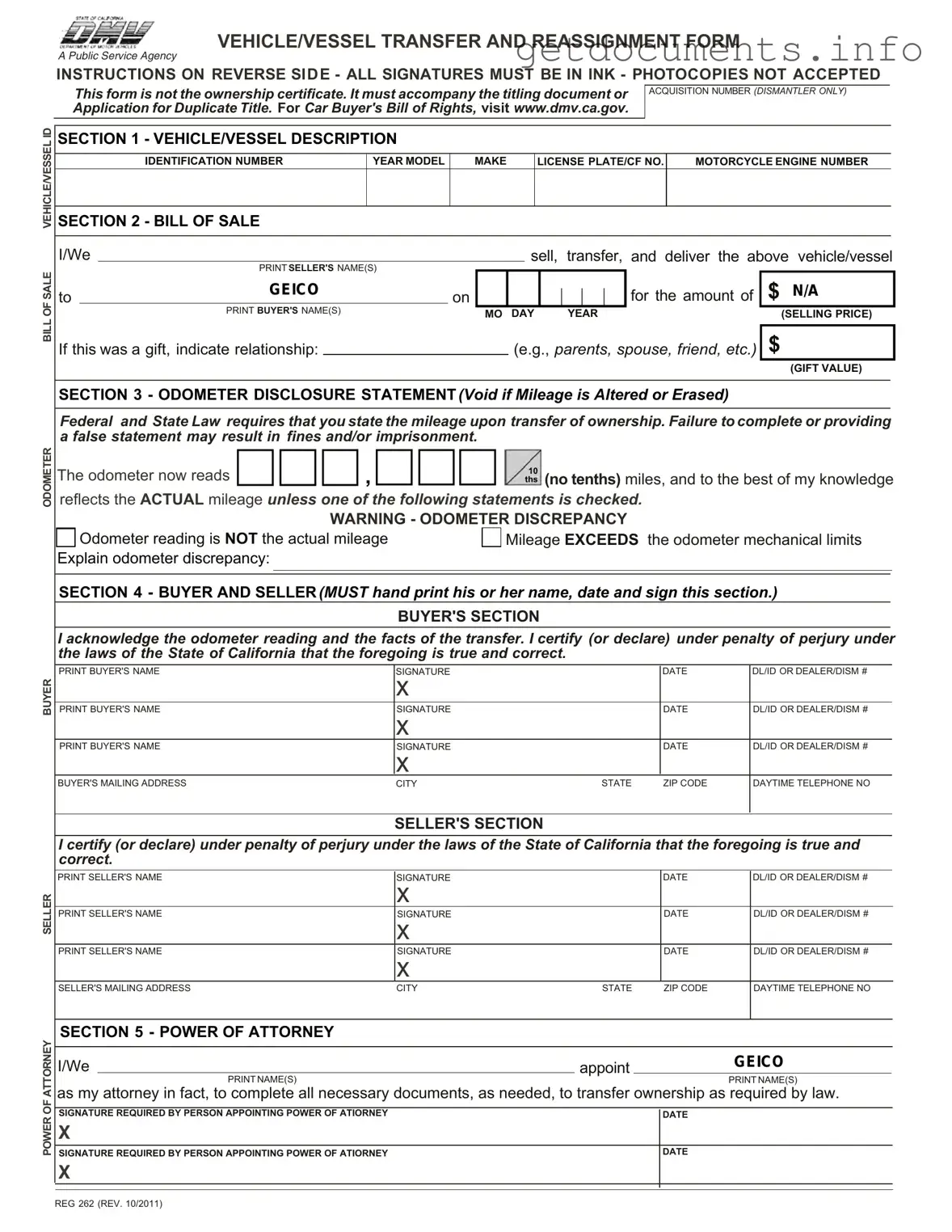

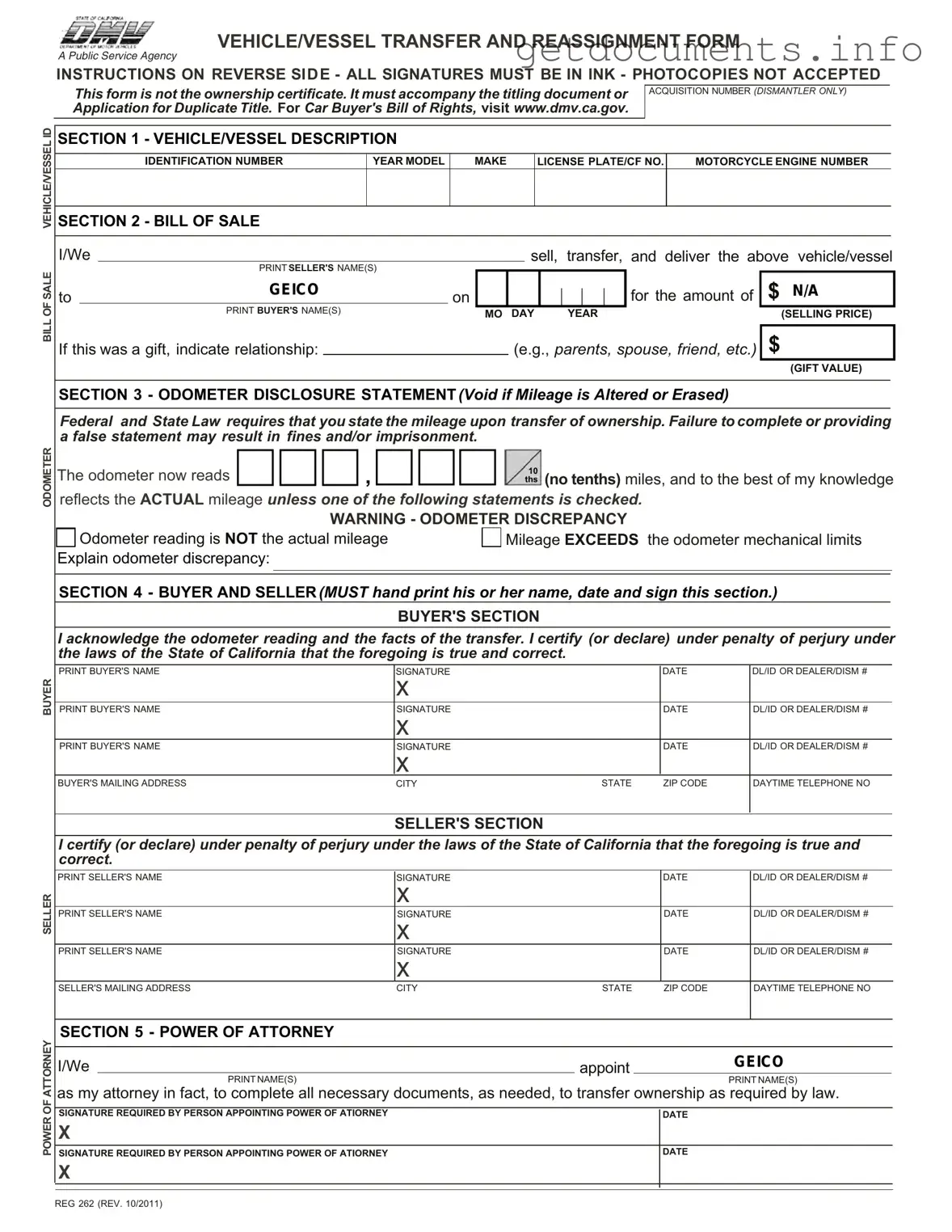

Official California Fotm Reg 262 Form

The California Form Reg 262 is a critical document used for the transfer and reassignment of vehicle or vessel ownership. This form is not the ownership certificate itself; rather, it must accompany the title or an application for a duplicate title. Understanding how to properly fill out this form is essential for both buyers and sellers to ensure a smooth transaction.

If you're ready to fill out the form, click the button below.

Access California Fotm Reg 262 Editor

Official California Fotm Reg 262 Form

Access California Fotm Reg 262 Editor

Got places to be? Complete the form fast

Fill out California Fotm Reg 262 online and avoid printing or scanning.

Access California Fotm Reg 262 Editor

or

⇩ PDF File