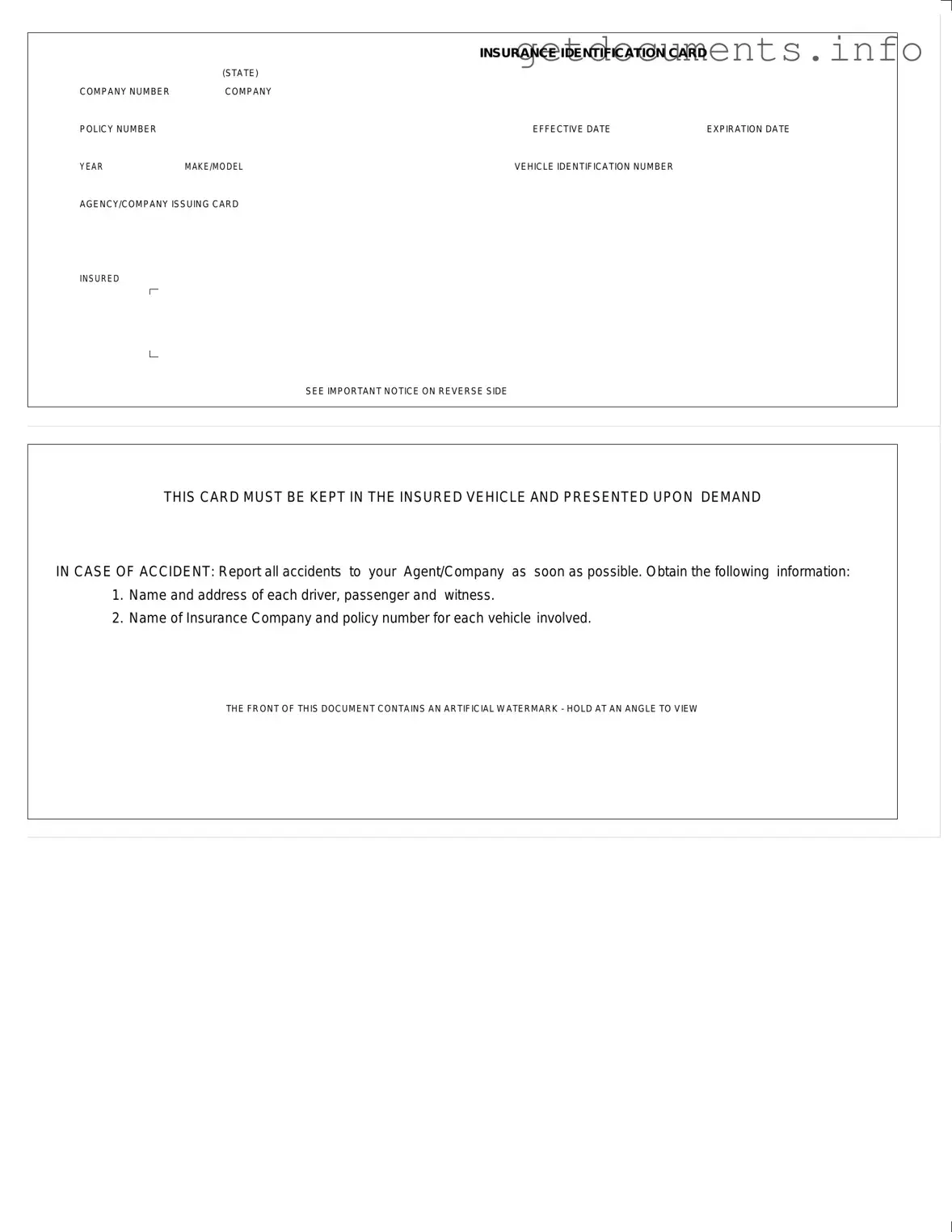

Official Auto Insurance Card Form

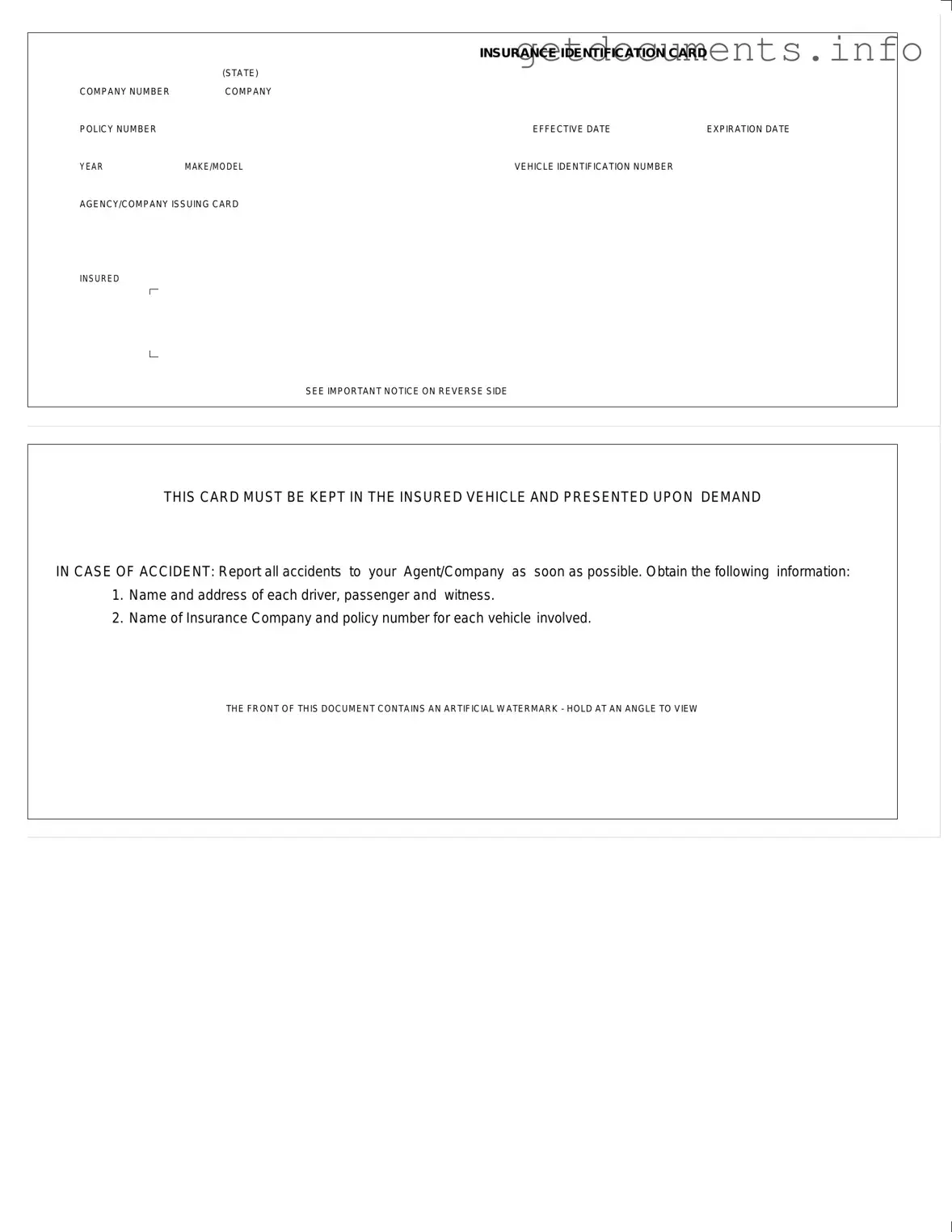

An Auto Insurance Card is a crucial document that serves as proof of insurance coverage for your vehicle. It contains important details such as the insurance company, policy number, and vehicle identification number, ensuring that you are protected while driving. Keeping this card in your vehicle is essential, as it must be presented upon request in the event of an accident.

To fill out the Auto Insurance Card form, click the button below.

Access Auto Insurance Card Editor

Official Auto Insurance Card Form

Access Auto Insurance Card Editor

Got places to be? Complete the form fast

Fill out Auto Insurance Card online and avoid printing or scanning.

Access Auto Insurance Card Editor

or

⇩ PDF File