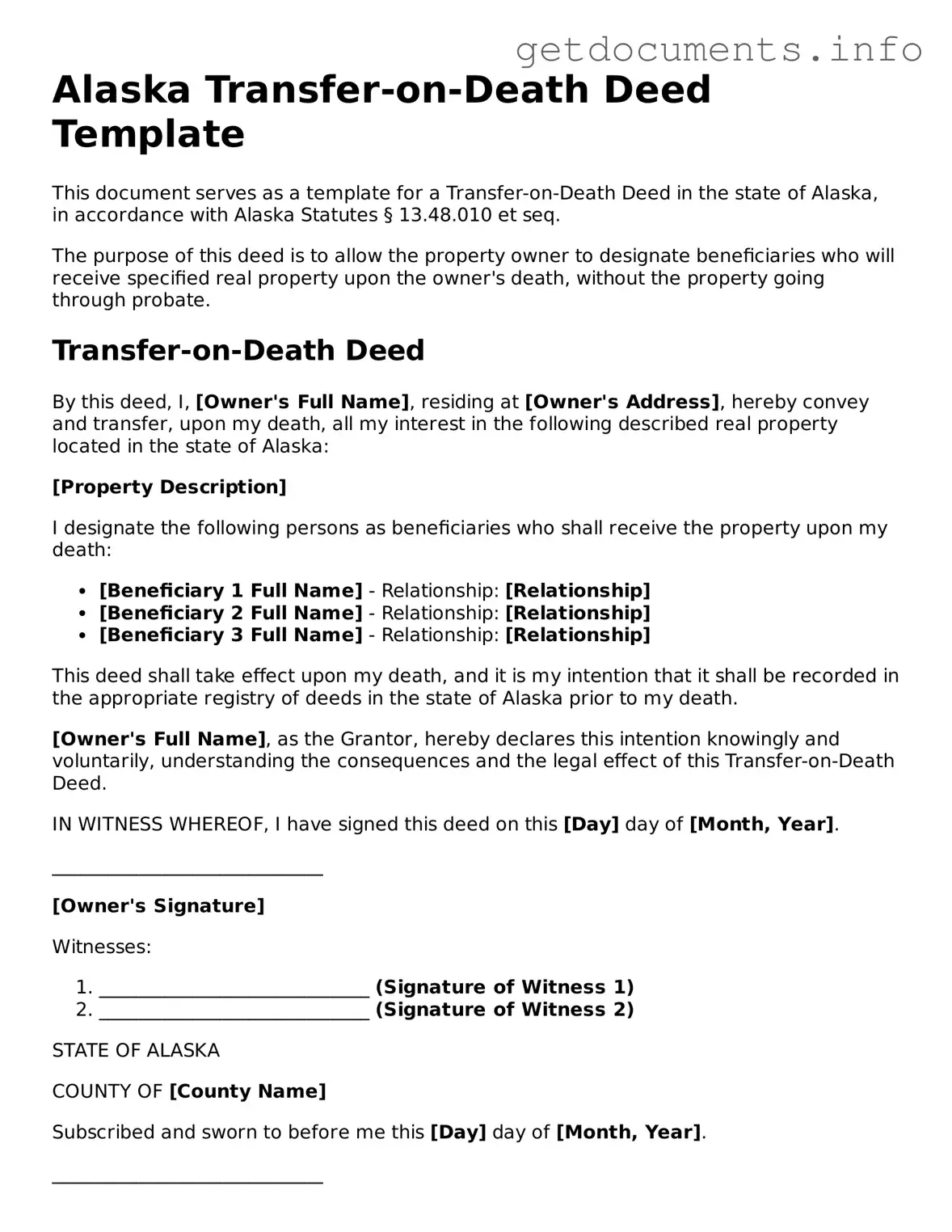

Free Transfer-on-Death Deed Template for Alaska

The Alaska Transfer-on-Death Deed form allows individuals to transfer real property to beneficiaries upon their death, bypassing the probate process. This legal tool provides a straightforward way to ensure that property is passed on according to one's wishes. To get started with your own Transfer-on-Death Deed, fill out the form by clicking the button below.

Access Transfer-on-Death Deed Editor

Free Transfer-on-Death Deed Template for Alaska

Access Transfer-on-Death Deed Editor

Got places to be? Complete the form fast

Fill out Transfer-on-Death Deed online and avoid printing or scanning.

Access Transfer-on-Death Deed Editor

or

⇩ PDF File