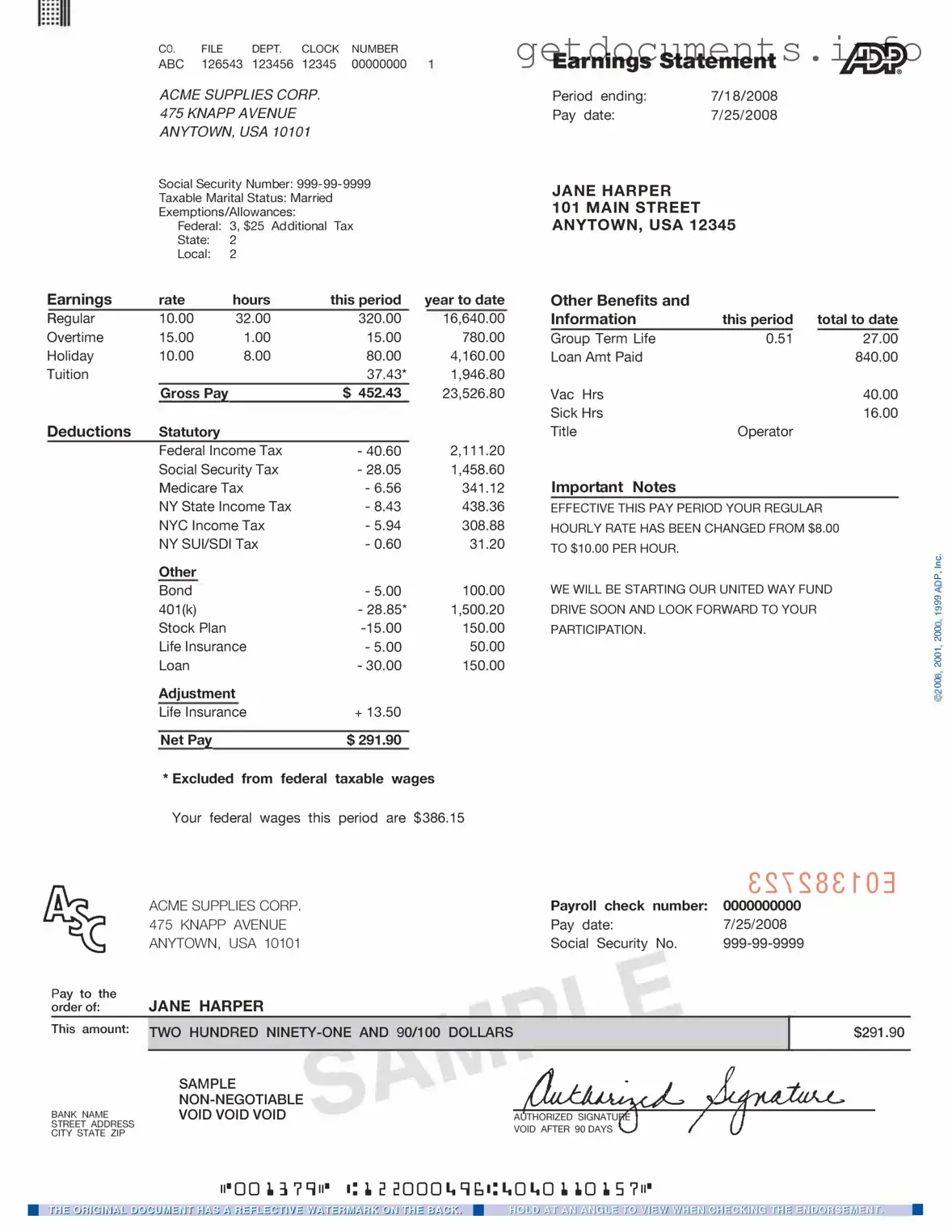

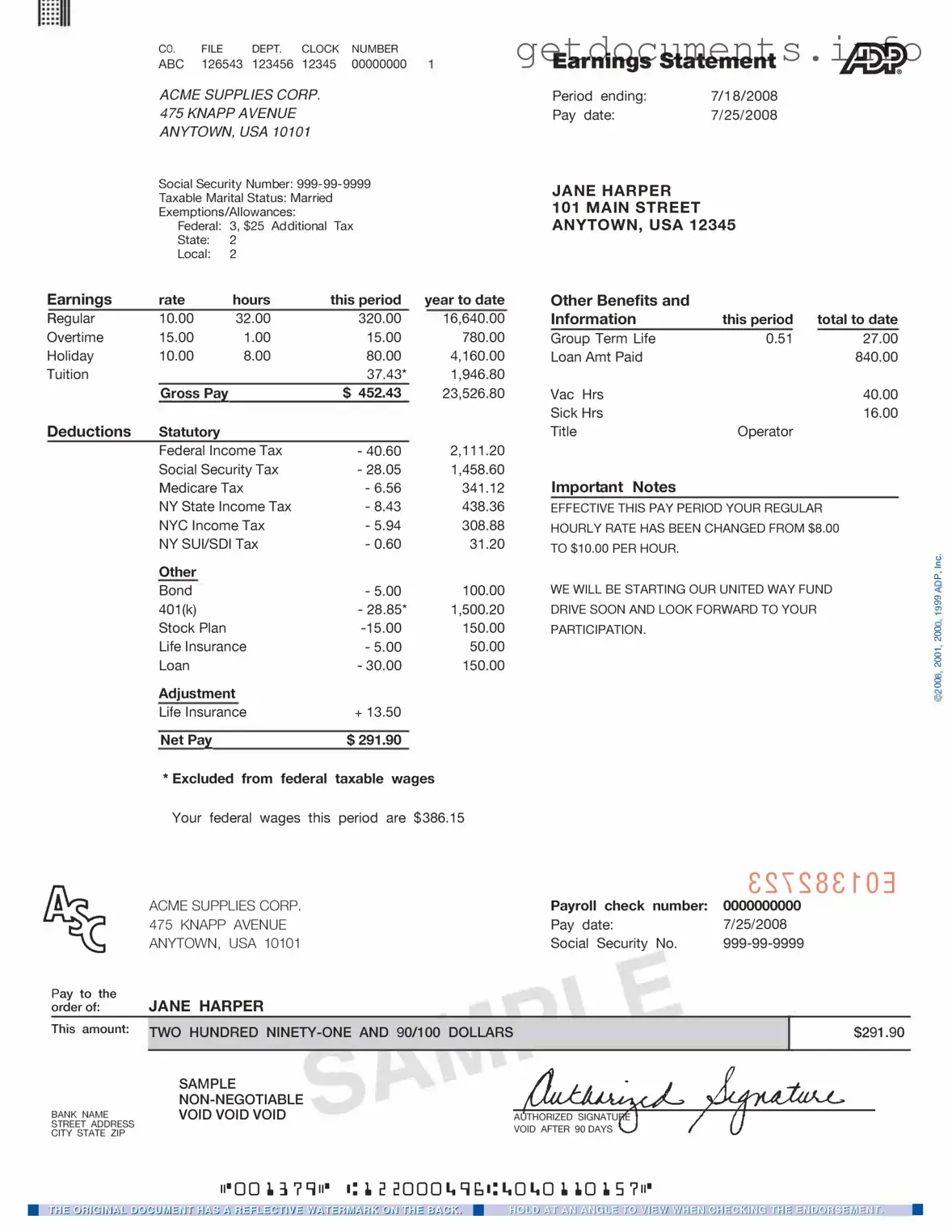

Official Adp Pay Stub Form

The ADP Pay Stub form is a document that provides employees with a detailed breakdown of their earnings, deductions, and net pay for a specific pay period. Understanding this form is crucial for managing personal finances and ensuring accurate record-keeping. Ready to take control of your pay information? Fill out the form by clicking the button below.

Access Adp Pay Stub Editor

Official Adp Pay Stub Form

Access Adp Pay Stub Editor

Got places to be? Complete the form fast

Fill out Adp Pay Stub online and avoid printing or scanning.

Access Adp Pay Stub Editor

or

⇩ PDF File